Business, 13.10.2020 04:01 sofia467735

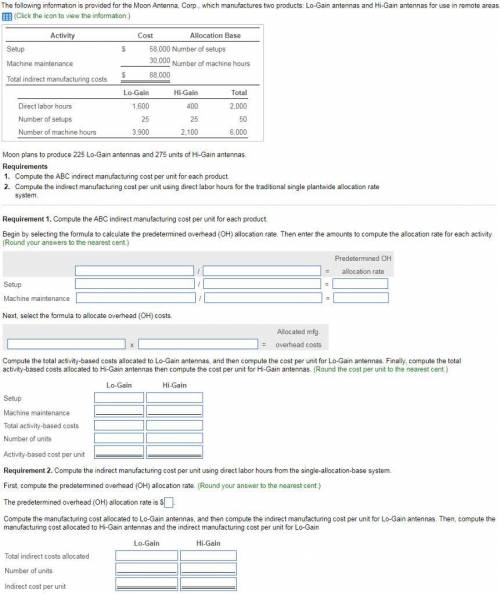

The following information is provided for the Moon Antenna, Corp., which manufactures two products: Lo-Gain antennas and Hi-Gain antennas for use in remote areas EEB (Click the icon to view the information.) Activity Cost Allocation Base 58,000 Number of setups 30,000 Number of machine hours 88,000 Set up Machine maintenance Total indirect manufacturing costs Direct labor hours Number of setups Number of machine hours Lo-Gain 1,600 25 3,900 Hi-Gain 400 25 2,100 Total 2,000 50 6,000 Moon plans to produce 225 Lo-Gain antennas and 275 units of Hi-Gain antennas Requirements 1. Compute the ABC indirect manufacturing cost per unit for each product. 2. Compute the indirect manufacturing cost per unit using direct labor hours for the traditional single plantwide allocation rate system

Requirement 1. Compute the ABC indirect manufacturing cost per unit for each product. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rateor each activity. Round your answers to the nearest cent.) Predetermined OH allocation rate Setup Machine maintenance Next, select the formula to allocate overhead (OH) costs Allocated mfg. overhead costs Compute the total activity-based costs allocated to Lo-Gain antennas, and then compute the cost per unit for Lo-Gain antennas. Finally, compute the total activity-based costs allocated to Hi-Gain antennas then compute the cost per unit for Hi-Gain antennas. (Round the cost per unit to the nearest cent.) Lo-Gain Hi-Gain Setup Machine maintenance Total activity-based costs Number of units Activity-based cost per unit

Requirement 2. Compute the indirect manufacturing cost per unit using direct labor hours from the single-allocation-base system. First, compute the predetermined overhead (OH) allocation rate. (Round your answer to the nearest cent.) The predetermined overhead (OH) allocation rate is S Compute the manufacturing cost allocated to Lo-Gain antennas, and then compute the indirect manufacturing cost per unit for Lo-Gain antennas. Then, compute the manufacturing cost allocated to Hi-Gain antennas and the indirect manufacturing cost per unit for Lo-Gain Lo-Gain Hi-Gain

Total indirect costs allocated Number of units Indirect cost per unit

Answers: 3

Another question on Business

Business, 22.06.2019 08:30

Most angel investors expect a return on investment of question options: 20% to 25% over 5 years. 15% to 20% over 5 years. 75% over 10 years. 100% over 5 years.

Answers: 1

Business, 22.06.2019 13:30

You operate a small advertising agency. you employ two secretaries, a graphic designer, three sales representatives, and an office coordinator. 1. what types of things would you consider when determining how to compensate each position? describe two (2) considerations. 2. what type of compensation plan would you use for each position?

Answers: 1

Business, 22.06.2019 17:30

The purchasing agent for a company that assembles and sells air-conditioning equipment in a latin american country noted that the cost of compressors has increased significantly each time they have been reordered. the company uses an eoq model to determine order size. what are the implications of this price escalation with respect to order size? what factors other than price must be taken into consideration?

Answers: 1

Business, 22.06.2019 22:50

Amonopolist’s inverse demand function is p = 150 – 3q. the company produces output at two facilities; the marginal cost of producing at facility 1 is mc1(q1) = 6q1, and the marginal cost of producing at facility 2 is mc2(q2) = 2q2.a. provide the equation for the monopolist’s marginal revenue function. (hint: recall that q1 + q2 = q.)mr(q) = 150 - 6 q1 - 3 q2b. determine the profit-maximizing level of output for each facility.output for facility 1: output for facility 2: c. determine the profit-maximizing price.$

Answers: 3

You know the right answer?

The following information is provided for the Moon Antenna, Corp., which manufactures two products:...

Questions

History, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

Physics, 12.06.2021 01:00

Arts, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

History, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

Mathematics, 12.06.2021 01:00

Computers and Technology, 12.06.2021 01:00