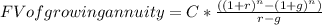

Bert and Bertha estimate when they retire in 18 years that their retirement portfolio will need to have a value of $2,000,000 to finance their desired retirement lifestyle. They believe inflation will average 2% over time and their retirement investment return will average 8% until they retire. After they retire, they will invest more conservatively and the portfolio will average a 5% return during a 25 year retirement. If they currently have nothing saved for retirement, how much will they need to save at the end of each year to meet their retirement goal

Answers: 3

Another question on Business

Business, 22.06.2019 09:40

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 13:50

Selected t-account balances for bloomfield company are shown below as of january 31, which reflect its accounting adjustments. the firm uses a calendar-year accounting period, but prepares monthly accounting adjustments.suppliesjan. 31 bal. 1,800 1,800 jan. 31 bal.supplies expensejan. 31 bal. 1,920 1,148 jan. 31 bal.prepaid insurancejan. 31 bal. 1,148 1,148 jan. 31 bal.insurance expensejan. 31 bal. 164 164 jan. 31 bal.wages payablejan. 31 bal. 1,400 1,400 jan. 31 bal.wages expensejan. 31 bal. 6,400 6,400 jan. 31 bal.truckjan. 31 bal. 17,376 17,376 jan. 31 bal.accumulated depreciation -truckjan. 31 bal. 5,068 5,068 jan. 31 bal.a. if the amount in supplies expense represents the january 31 adjustment for the supplies used in january, and $1,240 worth of supplies were purchased during january, what was the january 1 beginning balance of supplies? $answerb. the amount in the insurance expense account represents the adjustment made at january 31 for january insurance expense. if the original insurance premium was for one year, what was the amount of the premium, and on what date did the insurance policy start? amount of the premium $answerthe policy began on answerjune 1july 1august 1september 1october 1november 1 of the previous year.c. if we assume that no beginning balance existed in either in either wage payable or wage expense on january 1, how much cash was paid as wages during january? $answerd. if the truck has a useful life of four years (or 48 months), what is the monthly amount of depreciation expense, and how many months has bloomfield owned the truck? answermonths

Answers: 1

Business, 22.06.2019 21:10

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i.e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

Business, 22.06.2019 21:30

Which is the most compelling reason why mobile advertising is related to big data?

Answers: 1

You know the right answer?

Bert and Bertha estimate when they retire in 18 years that their retirement portfolio will need to h...

Questions

Social Studies, 31.12.2020 22:40

Mathematics, 31.12.2020 22:40

Mathematics, 31.12.2020 22:40

Mathematics, 31.12.2020 22:40

Mathematics, 31.12.2020 22:40

Chemistry, 31.12.2020 22:40

Mathematics, 31.12.2020 22:40

Computers and Technology, 31.12.2020 22:40

Mathematics, 31.12.2020 22:40