Business, 20.09.2020 19:01 MariaGuerra

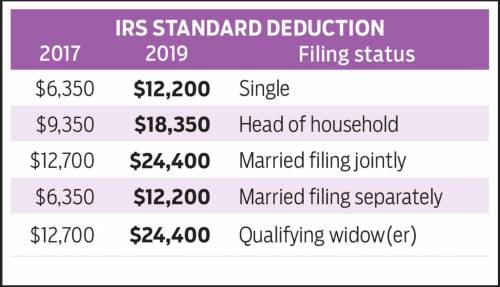

Jason and Mary are married taxpayers in 2019. They are both under age 65 and in good health. For 2019 they have a total of $41,000 in wages and $700 in interest income. Jason and Mary's deductions for adjusted gross income amount to $5,000 and their itemized deductions equal $18,700. They have two children, ages 32 and 28, that are married and provide support for themselves.

Required:

a. What is the amount of Jason and Mary's adjusted gross income?

b. What is the amount of their itemized deductions or standard deduction?

c. What is their 2016 taxable income?

Answers: 1

Another question on Business

Business, 22.06.2019 12:00

Agovernment receives a gift of cash and investments with a fair value of $200,000. the donor specified that the earnings from the gift must be used to beautify city-owned parks and the principal must be re-invested. the $200,000 gift should be accounted for in which of the following funds? a) general fund b) private-purpose trust fund c) agency fund d) permanent fund

Answers: 1

Business, 24.06.2019 06:00

Deciding what the distribution of income should be is an example of normative economics. a. true b. false

Answers: 2

Business, 24.06.2019 08:50

"some people view cosmetic surgery (c) and facials (f) as perfect substitutes as measured by the utility function u(c,f) = 5c + 10f. what is the marginal utility of cosmetic surgery? "

Answers: 1

Business, 24.06.2019 09:30

The market system's answer to the fundamental question "how will the goods and services be produced? " is essentially

Answers: 1

You know the right answer?

Jason and Mary are married taxpayers in 2019. They are both under age 65 and in good health. For 201...

Questions

English, 27.07.2019 22:00

Mathematics, 27.07.2019 22:00

English, 27.07.2019 22:00

Geography, 27.07.2019 22:00

Advanced Placement (AP), 27.07.2019 22:00

History, 27.07.2019 22:00

Mathematics, 27.07.2019 22:00

Computers and Technology, 27.07.2019 22:00

Chemistry, 27.07.2019 22:00