Business, 03.09.2020 01:01 chaycebell74021

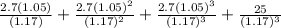

Davenport Corporation's last dividend was $2.70, and the directors expect to maintain the historic 3% annual rate of growth. You plan to purchase the stock today because you feel that the growth rate will increase to 5% for the next three years and the stock will then reach $25 per share.1. How much should you be willing to pay for the stock if you require a 17% return? 2. How much should you be willing to pay for the stock if yo feel that the 5% growth rate can be maintained indefinitely and you require a 17% return?

Answers: 2

Another question on Business

Business, 21.06.2019 17:30

Consider the following two stocks, a and b. stock a has an expected return of 10%, 10% standard deviation, and a beta of 1.20. stock b has an expected return of 14%, 25% standard deviation, and a beta of 1.80. the expected market rate of return is 9% and the risk-free rate is 5%. security would be considered a good buy if we include the stock in a well diversified a portfolio because a. b, it offers better alpha b. a, it offers better alpha c. a, it offers better sharpe ratio d. b, it offers better sharpe ratio

Answers: 1

Business, 22.06.2019 05:50

Which is one solution to levy the complexity of the global matrix strategy with added customer-focused dimensions?

Answers: 3

Business, 22.06.2019 20:40

Helen tells her nephew, bernard, that she will pay him $100 if he will stop smoking for six months. helen was hopeful that if bernard stopped smoking for six months, he would stop altogether. bernard stops smoking for six months but then resumes his smoking. helen will not pay him. she says that the type of promise she made cannot constitute a binding contract and that, furthermore, it was at least implied that he would stop smoking for good. can bernard legally collect $100 from helen

Answers: 1

Business, 22.06.2019 21:00

Mr. beautiful, an organization that sells weight training sets, has an ordering cost of $40 for the bb-1 set. (bb-1 stands for body beautiful number 1.) the carrying cost for bb-1 is $5 per set per year. to meet demand, mr. beautiful orders large quantities of bb-1 seven times a year. the stockout cost for bb-1 is estimated to be $50 per set. over the past several years, mr. beautiful has observed the following demand during the lead time for bb-1: demand during lead time probability40 0.150 0.260 0.270 0.280 0.290 0.1total 1.0the reorder point for bb-1 is 60 sets. what level of safety stock should be maintained for bb-1?

Answers: 3

You know the right answer?

Davenport Corporation's last dividend was $2.70, and the directors expect to maintain the historic 3...

Questions

Mathematics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

History, 25.01.2022 01:00

Physics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Computers and Technology, 25.01.2022 01:00

Computers and Technology, 25.01.2022 01:00