Business, 31.08.2020 01:01 carlyfaith3375

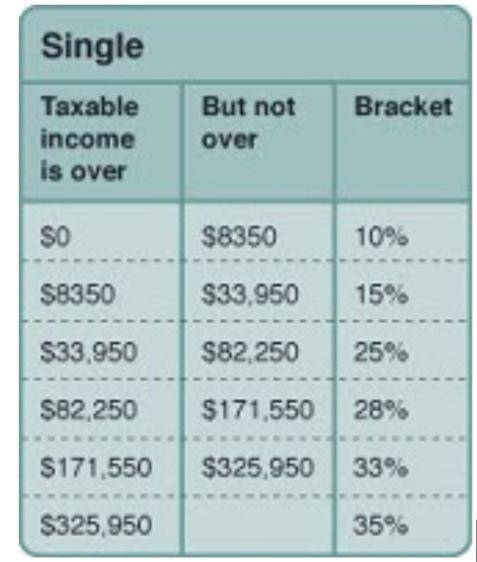

Lewis is single, and he is trying to decide whether to contribute $5000 to a traditional IRA or to a Roth IRA. His taxable income is currently $94,000 per year, and he expects it to be $190,000 per year when he takes his money out of his IRA. He also expects his $5000 investment to triple in value by the time he takes his money out. Use this information and the tax table below to assist Lewis in making his decision. Assume that current tax brackets will stay the same by the time Lewis takes his money out of his IRA

Part I: If Lewis chooses a traditional IRA, how much will he pay in taxes now on the $5000?

Part II: If Lewis chooses a traditional IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part III: If Lewis chooses a Roth IRA, how much will he pay in taxes now on the $5000?

Part IV: If Lewis chooses a Roth IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part V: Will choosing a traditional IRA or a Roth IRA cause Lewis to pay more in taxes? How much more will Lewis pay?

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

What is the most important factor that affects the value of a company? a) cash flow b) earnings c) supply and demand d) number of employees

Answers: 1

Business, 22.06.2019 07:00

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 11:30

10. lucy is catering an important luncheon and wants to make sure her bisque has the perfect consistency. for her bisque to turn out right, it should have the consistency of a. cold heavy cream. b. warm milk. c. foie gras. d. thick oatmeal. student d incorrect

Answers: 2

Business, 22.06.2019 15:30

Careers in designing, planning, managing, building and maintaining the built environment can be found in the following career cluster: a. agriculture, food & natural resources b. architecture & construction c. arts, audio-video technology & communications d. business, management & administration

Answers: 2

You know the right answer?

Lewis is single, and he is trying to decide whether to contribute $5000 to a traditional IRA or to a...

Questions

Mathematics, 19.10.2019 05:30

History, 19.10.2019 05:30

Chemistry, 19.10.2019 05:30

Mathematics, 19.10.2019 05:30

Mathematics, 19.10.2019 05:30

Mathematics, 19.10.2019 05:30

Geography, 19.10.2019 05:30

History, 19.10.2019 05:30

Social Studies, 19.10.2019 05:30

Mathematics, 19.10.2019 05:30

History, 19.10.2019 05:30

Social Studies, 19.10.2019 05:30