Business, 22.08.2020 17:01 genyjoannerubiera

Having recently graduated, Jack and Jill just started working for the same company. The company has offered each of them a retirement savings plan (e. g., an Individual Retirement Annuity, sometimes called an IRA) in which for each year that they save $5000 in the retirement plan, the company will also contribute $5000 to their plan. Contributions to the plan, if any, are made at the end of each year, and the money in the plan is invested in a broad index of stocks. Jill has decided to start the plan immediately-contributing $5000 at the end of each year for the next 30 years. Jack has decided postpone his starting the plan for 6 years because of his loan payments for a Tesla. Thus, Jack will make his first contribution to the plan in year 7. Use Excel to answer the following:

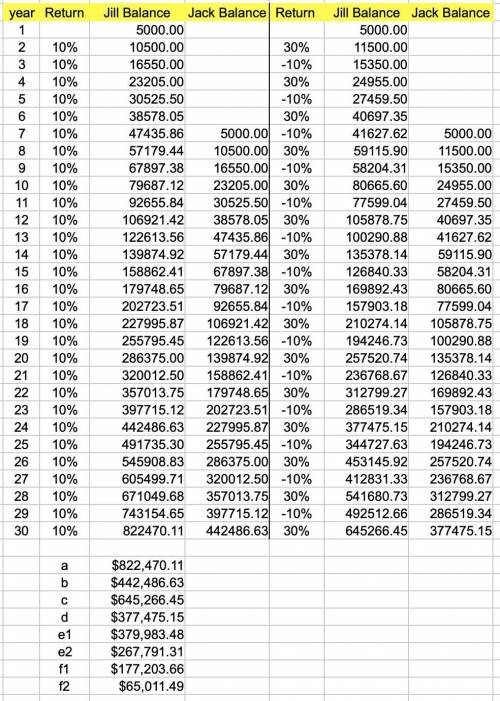

(a) If the return each year is exactly 10%, how much will Jill have in the account at the beginning of year 31?

(b) If the return each year is exactly 10%, how much will Jack have in the account at the beginning of year 31? (Recall Jack only contributed for 25 years)

(c) Suppose that instead the returns alternate between 30% and-10% (i. e., 30% for year 1, -10% for year 2, 30% for year 3, -10% for year 4, 30% for year 5, etc. Observe that the average return is 10%. How much will Jill have in the account at the beginning of year 31?

(d) If, similar to (c), the returns alternate between 30% and -10%, how much will Jack have in the account at the beginning of year 31?

(e) What is the difference between your answers to (a) and (b)? Also what is the difference between your answers (c) and (d)? What insight does this give?

(f) What is the difference between your answers to (a) and (c)? Also what is the difference between your answers (b) and (d)? What insight does this give?

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 15:20

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

Business, 22.06.2019 19:00

By 2020, automobile market analysts expect that the demand for electric autos will increase as buyers become more familiar with the technology. however, the costs of producing electric autos may increase because of higher costs for inputs (e.g., rare earth elements), or they may decrease as the manufacturers learn better assembly methods (i.e., learning by doing). what is the expected impact of these changes on the equilibrium price and quantity for electric autos?

Answers: 1

Business, 22.06.2019 21:50

Required: 1-a. the marketing manager argues that a $5,000 increase in the monthly advertising budget would increase monthly sales by $9,000. calculate the increase or decrease in net operating income. 1-b. should the advertising budget be increased ? yes no hintsreferencesebook & resources hint #1 check my work 8.value: 1.00 pointsrequired information 2-a. refer to the original data. management is considering using higher-quality components that would increase the variable expense by $2 per unit. the marketing manager believes that the higher-quality product would increase sales by 10% per month. calculate the change in total contribution margin. 2-b. should the higher-quality components be used? yes no

Answers: 1

You know the right answer?

Having recently graduated, Jack and Jill just started working for the same company. The company has...

Questions

History, 22.09.2019 05:50

Business, 22.09.2019 05:50

English, 22.09.2019 05:50

Health, 22.09.2019 05:50