Business, 20.08.2020 22:01 alisonlebron15

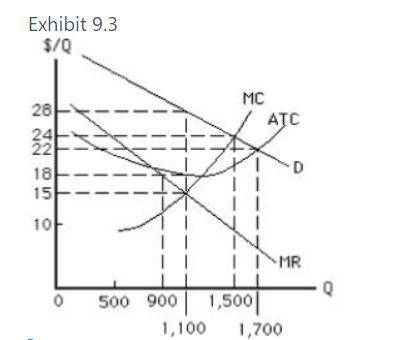

Refer to Exhibit 9.3, which shows the cost and revenue curves for a non-discriminating monopolist. The total cost incurred by the monopolist for producing the profit-maximizing output is Group of answer choices $16,500. $24,200. $16,200. $19,800. $30,800.

Answers: 1

Another question on Business

Business, 22.06.2019 05:50

Acompany that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. prior to buying the new equipment, the company used 6 workers, who produced an average of 79 carts per hour. workers receive $16 per hour, and machine coast was $49 per hour. with the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $11 per hour while output increased by four carts per hour. a) compute the multifactor productivity (mfp) (labor plus equipment) under the prior to buying the new equipment. the mfp (carts/$) = (round to 4 decimal places). b) compute the productivity changes between the prior to and after buying the new equipment. the productivity growth = % (round to 2 decimal places)

Answers: 3

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 11:10

The green fiddle has declared a $5 per share dividend. suppose capital gains are not taxed, but dividends are taxed at 15 percent. new irs regulations require that taxes be withheld at the time the dividend is paid. green fiddle stock sells for $71.50 per share, and the stock is about to go ex-dividend. what will the ex-dividend price be?

Answers: 2

You know the right answer?

Refer to Exhibit 9.3, which shows the cost and revenue curves for a non-discriminating monopolist. T...

Questions

History, 30.10.2020 18:30

Business, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30

Biology, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30

Chemistry, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30

English, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30

English, 30.10.2020 18:30

Mathematics, 30.10.2020 18:30