Answers: 1

Another question on Business

Business, 21.06.2019 16:40

Elephant, inc.'s cost of goods sold for the year is $2,000,000, and the average merchandise inventory for the year is $129,000. calculate the inventory turnover ratio of the company. (round your answer to two decimal places.)

Answers: 1

Business, 22.06.2019 19:10

Fortress international, a large conglomerate, procures a few component parts from external suppliers and also manufactures some of the key raw materials in its own subsidiaries. aside from this, the company does not solely depend on outside distributors to reach its customers. in fact, it has its own retail stores to distribute its products. in this scenario, which of the following alternatives to vertical integration is fortress international applying? a. concentric integration b. taper integration c. horizontal integration d. conglomerate integration

Answers: 1

Business, 22.06.2019 21:30

The adjusted trial balance for china tea company at december 31, 2018, is presented below:

Answers: 1

Business, 23.06.2019 01:00

What is the average price for the cordless telephones (to 2 decimals)? $ b. what is the average talk time for the cordless telephones (to 3 decimals)? hours c. what percentage of the cordless telephones have a voice quality of excellent? % d. what percentage of the cordless telephones have a handset on the base?

Answers: 3

You know the right answer?

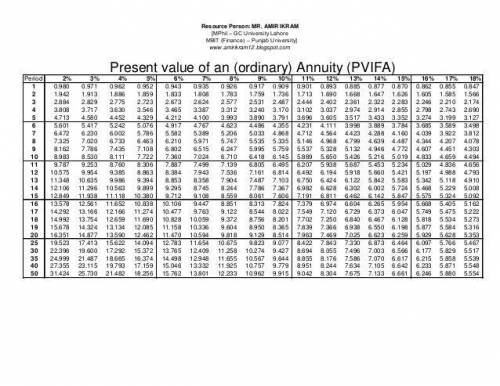

"The net present value of the investment, excluding the annual cash inflow, is −$403,414. To the nea...

Questions

Chemistry, 05.10.2019 20:00

Social Studies, 05.10.2019 20:00

Biology, 05.10.2019 20:00

Social Studies, 05.10.2019 20:00

Physics, 05.10.2019 20:00

English, 05.10.2019 20:00

English, 05.10.2019 20:00

Computers and Technology, 05.10.2019 20:00