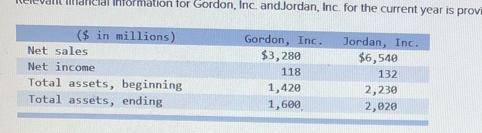

Relevant financial information for Gordon, Inc. andJordan, Inc. for the current year is provided below. ($ in millions) Net sales Net income Total assets, beginning Total assets, ending Gordon, Inc. $3,280 118 1,420 Jordan, Inc. $6,540 132 1,600 2,230 2,020 Based on these data, which of the following is a correct conclusion?

A) Return on Assets is 7.4% for Gordon and 6.5% for Jordan. Thus, Gordon is more profitable than Jordan

B) Return on Assets is 7.4% for Gordon and 6.5% for Jordan. Thus, Gordon is less profitable than Jordan

C) Return on Assets is 7.8% for Gordon and 6.2% for Jordan. Thus, Gordon is more profitable than Jordan

D) Return on Assets is 7.8% for Gordon and 6.2% for Jordan. Thus, Gordon is less profitable than Jordan

Answers: 3

Another question on Business

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

Business, 22.06.2019 21:10

Upon completion of the northwest-corner rule, which source-destination cell is guaranteed to be occupied? a. top-leftb. the cell with the lowest shipping costc. bottom-leftd. top-righte. bottom-right

Answers: 1

Business, 22.06.2019 22:20

Which of the following events could increase the demand for labor? a. an increase in the marginal productivity of workers b. a decrease in the amount of capital available for workers to use c. a decrease in the wage paid to workers d. a decrease in output price

Answers: 1

You know the right answer?

Relevant financial information for Gordon, Inc. andJordan, Inc. for the current year is provided bel...

Questions

Mathematics, 10.06.2020 18:57

English, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57

Biology, 10.06.2020 18:57

History, 10.06.2020 18:57

History, 10.06.2020 18:57

Social Studies, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57