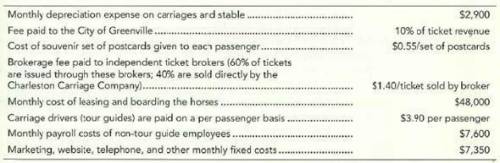

Carter Carriage Company offers guided horse-drawn carriage rides through historic Sumter comma South Carolina. The carriage business is highly regulated by the city. Carter Carriage Company has the following operating costs during April: LOADING...(Click the icon to view the information.) During April (a month during peak season), Carter Carriage Company had 13 comma 400 passengers. Eighty percent of passengers were adults ($20 fare) while 20% were children ($12 fare). Requirements 1. Prepare the company's contribution margin income statement for the month of April. Round all figures to the nearest dollar. 2. Assume that passenger volume increases by 20% in May. Which figures on the income statement would you expect to change, and by what percentage would they change? Which figures would remain the same as in April?

Answers: 3

Another question on Business

Business, 22.06.2019 00:20

Suppose an economy consists of three sectors: energy (e), manufacturing (m), and agriculture (a). sector e sells 70% of its output to m and 30% to a. sector m sells 30% of its output to e, 50% to a, and retains the rest. sector a sells 15% of its output to e, 30% to m, and retains the rest.

Answers: 1

Business, 22.06.2019 08:00

Shrieves casting company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by sidney johnson, a recently graduated mba. the production line would be set up in unused space in the main plant. the machinery’s invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. the machinery has an economic life of 4 years, and shrieves has obtained a special tax ruling that places the equipment in the macrs 3-year class. the machinery is expected to have a salvage value of $25,000 after 4 years of use. the new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. each unit can be sold for $200 in the first year. the sales price and cost are both expected to increase by 3% per year due to inflation. further, to handle the new line, the firm’s net working capital would have to increase by an amount equal to 12% of sales revenues. the firm’s tax rate is 40%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 10%. define “incremental cash flow.” (1) should you subtract interest expense or dividends when calculating project cash flow?

Answers: 1

Business, 22.06.2019 12:40

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

Business, 22.06.2019 19:00

Adrawback of short-term contracting as an alternative to making a component in-house is thata. it is the most-integrated alternative to performing an activity so the principal company has no control over the agent. b. the supplying firm has no incentive to make any transaction-specific investments to increase performance or quality. c. it fails to allow a long planning period that individual market transactions provide. d. the buying firm cannot demand lower prices due to the lack of a competitive bidding process.

Answers: 2

You know the right answer?

Carter Carriage Company offers guided horse-drawn carriage rides through historic Sumter comma South...

Questions

Mathematics, 04.08.2021 21:50

Mathematics, 04.08.2021 21:50

Biology, 04.08.2021 21:50

Mathematics, 04.08.2021 21:50

Social Studies, 04.08.2021 21:50

Mathematics, 04.08.2021 21:50

Mathematics, 04.08.2021 21:50

Biology, 04.08.2021 21:50

Mathematics, 04.08.2021 21:50