McEwan Industries sells on terms of 3/10, net 40, Total sales for the year are $838,000; 40% of the customers pay on the 10th day and take discounts, while the other 60% pay, on average, 84 days after their purchases. Assume 365 days in year for your calculations

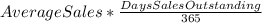

a. What is the days sales outstanding? Round your answer to two decimal places. days

b. What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest cent.

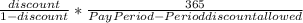

c. What is the percentage cost of trade credit to customers who take the discount? If your answer is zero, enter zero. Round your answer to two decimal places.

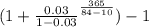

d. What is the percentage cost of trade credit to customers who do not take the discount and pay in 84 days? If your answer is zero, enter zero. Do not round intermediate calculations. Round your answers to two decimal places.

Nominal cost:

Effective cost:

e. What would happen to McEwan's accounts receivable if it toughened up on its collection policy with the result that all nondiscount customers paid on the 40th day?

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

Actual usage for the year by the marketing department was 70,000 copies and by the operations department was 330,000 copies. if a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the operations department?

Answers: 2

Business, 22.06.2019 12:30

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 14:40

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate.the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received.c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

Business, 22.06.2019 19:50

Our uncle has $300,000 invested at 7.5%, and he now wants to retire. he wants to withdraw $35,000 at the end of each year, starting at the end of this year. he also wants to have $25,000 left to give you when he ceases to withdraw funds from the account. for how many years can he make the $35,000 withdrawals and still have $25,000 left in the end? a. 14.21b. 14.96c. 15.71d. 16.49e. 17.32

Answers: 1

You know the right answer?

McEwan Industries sells on terms of 3/10, net 40, Total sales for the year are $838,000; 40% of the...

Questions

Mathematics, 22.11.2019 10:31

Computers and Technology, 22.11.2019 10:31

History, 22.11.2019 10:31

Social Studies, 22.11.2019 10:31

Social Studies, 22.11.2019 10:31

Mathematics, 22.11.2019 10:31

Mathematics, 22.11.2019 10:31

Social Studies, 22.11.2019 10:31

History, 22.11.2019 10:31

Social Studies, 22.11.2019 10:31