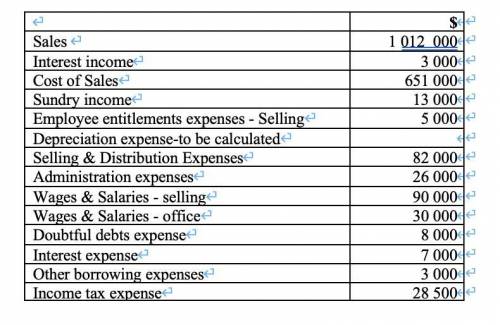

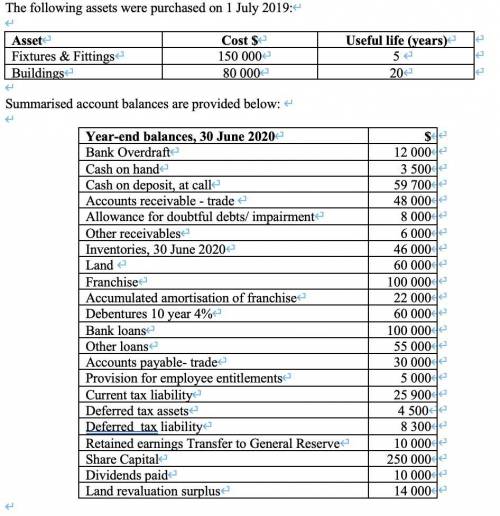

GETFIT Ltd, a retail sports equipment company, commenced operations on 10 May 2019 by issuing 200 000 $1.25 shares, payable in full on application on a first-come, first-served basis. By 20 June 2019 the shares were fully subscribed and duly allotted. There were no share issue costs. The company did not commence trading until 1 July 2019. For the year ending 30 June 2020, the company recorded the following aggregate transactions: $ Sales 1 012 000 Interest income 3 000 Cost of Sales 651 000 Sundry income 13 000 Employee entitlements expenses - Selling 5 000 Depreciation expense-to be calculated Selling & Distribution Expenses 82 000 Administration expenses 26 000 Wages & Salaries - selling 90 000 Wages & Salaries - office 30 000 Doubtful debts expense 8 000 Interest expense 7 000 Other borrowing expenses 3 000 Income tax expense 28 500 The following additional information was noted during the preparation of financial statements for the year ended 30 June 2020: (a) A cash dividend of 5 cents per share was declared and paid during the 2020 financial year and a final dividend for 2020 of $22 000 was proposed but not recognised in the financial statements. (b) The land was revalued upward by $20 000 (related income tax 6 000) by Real Valuations Pty Ltd during the year ended 30 June 2020. (c) Transferred $10 000 out of retained earnings into general reserve. (d) $40 000 of other loans is repayable in one year. (e) The Bank loan is for 5 years and repayable in full at the end of the term. The interest rate is 7% and it is secured over the land. (f) The provision for employee entitlements includes $4 000 payable within 1 year. (g) GETFIT Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement. (h) GETFIT Ltd measures inventory at the lower of cost and net realizable value. The cost model is applied to buildings, plant and equipment. The following assets were purchased on 1 July 2019: Asset Cost $ Useful life (years) Fixtures & Fittings 150 000 5 Buildings 80 000 20 Summarised account balances are provided below: Year-end balances, 30 June 2020 $ Bank Overdraft 12 000 Cash on hand 3 500 Cash on deposit, at call 59 700 Accounts receivable - trade 48 000 Allowance for doubtful debts/ impairment 8 000 Other receivables 6 000 Inventories, 30 June 2020 46 000 Land 60 000 Franchise 100 000 Accumulated amortisation of franchise 22 000 Debentures 10 year 4% 60 000 Bank loans 100 000 Other loans 55 000 Accounts payable- trade 30 000 Provision for employee entitlements 5 000 Current tax liability 25 900 Deferred tax assets 4 500 Deferred tax liability 8 300 Retained earnings Transfer to General Reserve 10 000 Share Capital 250 000 Dividends paid 10 000 Land revaluation surplus 14 000 Required: For the year ending 30 June 2020 (NOTE: comparative financial statements are not required), 1. Using the pro forma table supplied in appendix B, prepare a preliminary trial balance for Getfit Ltd; (5 Marks) 2. Prepare a statement of comprehensive income for Getfit Ltd in accordance with the requirements of AASB 101. Getfit Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement; (15 marks) 3. Prepare a statement of changes in equity for Getfit Ltd in accordance with the requirements of AASB 101; (8 marks) 4. Prepare a statement of financial position for Getfit Ltd in accordance with AASB 101. Use the current/non-current presentation format; (12 marks) 5. Prepare appropriate notes to the accounts. (You do not need to prepare notes related to income taxes. Include the following note as note 1. You may optionally add accounting policies to this note): (20 marks). “1. Summary of significant accounting policies Basis of accounting The financial report is a general purpose financial report which has been prepared on the historical cost basis, except where stated otherwise. Statement of Compliance The financial statements have been prepared in accordance with the requirements of the Corporations Act, Australian Accounting Standards which include Australian equivalents to International Financial Reporting Standards (AIFRSs) and AASB Interpretations. Compliance with AIFRSs ensures the financial statements and notes comply with International Financial Reporting Standards”

Answers: 1

Another question on Business

Business, 21.06.2019 22:00

Select the correct answers. mila is at a flea market. she has $50 in her wallet. she decides that she will spend $15 on jewelry, $20 on a pair of jeans, $5 on a t-shirt, and $10 on something to eat. she likes a one-of-a-kind t-shirt, but the seller is not ready to sell it for less than $8. she thinks of five ways to deal with this situation. which two choices indicate a trade-off?

Answers: 3

Business, 22.06.2019 11:40

In each of the following, what happens to the unemployment rate? does the unemployment rate give an accurate impression of what’s happening in the labor market? a.esther lost her job and begins looking for a new one.b.sam, a steelworker who has been out of work since his mill closed last year, becomes discouraged and gives up looking for work.c.dan, the sole earner in his family of 5, just lost his $90,000 job as a research scientist. immediately, he takes a part-time job at starbucks until he can find another job in his field.

Answers: 2

Business, 22.06.2019 12:30

land, a building and equipment are acquired for a lump sum of $ 1,000,000. the market values of the land, building and equipment are $ 300,000, $ 800,000 and $ 300,000, respectively. what is the cost assigned to the equipment? (do not round any intermediary calculations, and round your final answer to the nearest dollar.)

Answers: 1

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

You know the right answer?

GETFIT Ltd, a retail sports equipment company, commenced operations on 10 May 2019 by issuing 200 00...

Questions

Mathematics, 02.07.2019 20:20

English, 02.07.2019 20:20

Mathematics, 02.07.2019 20:20

Social Studies, 02.07.2019 20:20

Health, 02.07.2019 20:20

Mathematics, 02.07.2019 20:30

History, 02.07.2019 20:30

Chemistry, 02.07.2019 20:30

History, 02.07.2019 20:30