Business, 01.07.2020 16:01 Lizzyloves8910

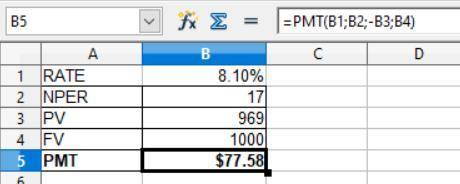

Big Canyon Enterprises has bonds on the market making annual payments, with 17 years to maturity, a par value of $1,000, and a price of $969. At this price, the bonds yield 8.1 percent. What must the coupon rate be on the bonds?

Answers: 2

Another question on Business

Business, 21.06.2019 16:10

Computing depreciation, net book value, and gain or loss on asset sale lynch company owns and operates a delivery van that originally cost $46,400. lynch has recorded straight-line depreciation on the van for four years, calculated assuming a $5,000 expected salvage value at the end of its estimated six-year useful life. depreciation was last recorded at the end of the fourth year, at which time lynch disposes of this van. compute the net bookvalue of the van on the disposal date.

Answers: 1

Business, 22.06.2019 15:10

Paying attention to the purpose of her speech, which questions can she eliminate? a. 1 and 2 b. 3 c. 2 and 4 d. 1-4

Answers: 2

Business, 22.06.2019 17:30

Gary lives in an area that receives high rainfall and thunderstorms throughout the year. which device would be useful to him to maintain his computer?

Answers: 2

You know the right answer?

Big Canyon Enterprises has bonds on the market making annual payments, with 17 years to maturity, a...

Questions

English, 18.05.2021 15:10

Mathematics, 18.05.2021 15:10

Physics, 18.05.2021 15:10

Mathematics, 18.05.2021 15:10

Geography, 18.05.2021 15:10

Biology, 18.05.2021 15:10

Mathematics, 18.05.2021 15:10

Chemistry, 18.05.2021 15:10

Mathematics, 18.05.2021 15:10

History, 18.05.2021 15:10

Chemistry, 18.05.2021 15:10

Mathematics, 18.05.2021 15:10