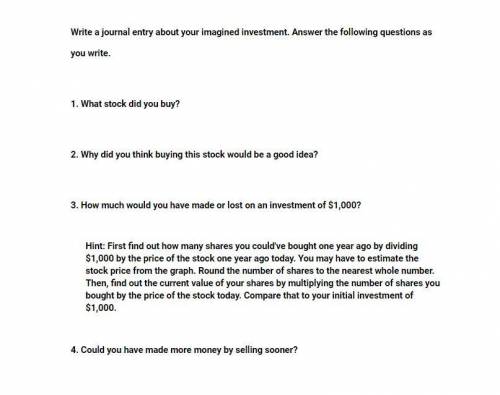

Now you're going to imagine that you invested $1,000 in a company one year ago, and you want to see how well your investment would be doing today. To begin, choose a company that you're familiar with and that seems as if it might be a good investment — that is, a company that you think will have rising stock prices. Think about companies that you use or know are popular. Remember, not all companies are public companies. You'll need to check the New York Stock Exchange to find out if you can actually buy shares in this company. Once you've settled on a company, find its stock price from one year ago and for today. Write a journal entry about your imagined investment. Answer the following questions.

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

technology is the application of knowledge and tools to solve problems and perform tasks more efficiently. t/f

Answers: 1

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

Business, 22.06.2019 19:40

Moody corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. at the beginning of the year, the company made the following estimates: machine-hours required to support estimated production 100,000 fixed manufacturing overhead cost $ 650,000 variable manufacturing overhead cost per machine-hour $ 3.00 required: 1. compute the plantwide predetermined overhead rate. 2. during the year, job 400 was started and completed. the following information was available with respect to this job: direct materials $ 450 direct labor cost $ 210 machine-hours used 40

Answers: 3

Business, 22.06.2019 20:00

Describe a real or made-up but possible example of a situation where an employee faces a conflict of interest. explain at least two things the company could do to make sure the employee won't be tempted into unethical behavior by that conflict of interest. (3.0 points)

Answers: 3

You know the right answer?

Now you're going to imagine that you invested $1,000 in a company one year ago, and you want to see...

Questions

English, 20.08.2019 23:40

Physics, 20.08.2019 23:40

Social Studies, 20.08.2019 23:40

Mathematics, 20.08.2019 23:40

Mathematics, 20.08.2019 23:40

History, 20.08.2019 23:40

World Languages, 20.08.2019 23:40

Mathematics, 20.08.2019 23:40

Mathematics, 20.08.2019 23:40

Biology, 20.08.2019 23:40