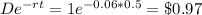

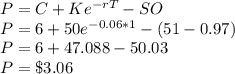

The price of a European call option on a stock with a strike price of $50 is $6. The stock price is $51, the continuously compounded risk-free rate (all maturities) is 6% and the time to maturity is one year. A dividend of $1 is expected in six months. What is the price of a one-year European put option on the stock with a strike price of $50?

Answers: 2

Another question on Business

Business, 22.06.2019 10:30

True or false: a fitted model with more predictors will necessarily have a lower training set error than a model with fewer predictors.

Answers: 2

Business, 22.06.2019 15:50

Evaluate a real situation between two economic actors; it could be any scenario: two competing businesses, two countries in negotiations, two kids trading baseball cards, you and another person involved in an exchange or anything else. use game theory to analyze the situation and the outcome (or potential outcome). be sure to explain the incentives, benefits and risks each face.

Answers: 1

Business, 22.06.2019 21:00

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $400 billion, (2) investment = $40 billion, (3) government purchases = $90 billion, and (4) net export = $25 billion. if the full-employment level of gdp for this economy is $600 billion, then what combination of actions would be most consistent with closing the gdp gap here?

Answers: 3

Business, 22.06.2019 23:30

Sports leave thousands of college athletes with little time for their studies. this is an example of

Answers: 1

You know the right answer?

The price of a European call option on a stock with a strike price of $50 is $6. The stock price is...

Questions

History, 03.05.2020 14:01

Mathematics, 03.05.2020 14:01

Mathematics, 03.05.2020 14:01

Mathematics, 03.05.2020 14:01

Mathematics, 03.05.2020 14:01

Mathematics, 03.05.2020 14:01

English, 03.05.2020 14:01

Chemistry, 03.05.2020 14:01

Mathematics, 03.05.2020 14:01

Mathematics, 03.05.2020 14:01