Business, 19.06.2020 11:57 darlasiller

National Park Tours Co. is a travel agency.

The nine transactions recorded by National Park Tours during May 2019, its first month of operations, are indicated in the following T accounts:

Cash:

(1) 75,000 (2) 900

(7) 8,150 (3) 1,600

4) 6,280

(6) 2,700

(9) 2,500

Equipment:

3) 8,000

Beth Worley, Drawing:

(9) 2,500

Accounts Receivable:

(5) 12,300 (7) 8,150

Accounts Payable:

(6) 2,700 (3) 6,400

Fees Earned:

(5) 12,300

Supplies:

(2) 900 (8) 660

Beth Worley, Capital:

1) 75,000

Operating Expenses:

(4) 6,280

(8) 660

Required:

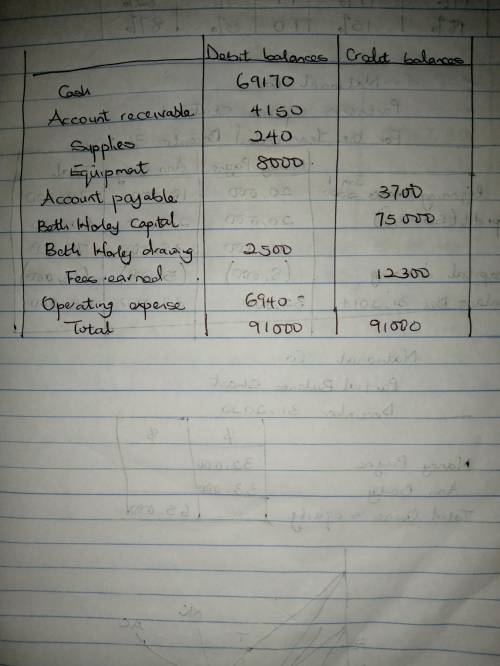

a. Prepare an unadjusted trial balance, listing the accounts in their proper order.

Place the amounts in the proper columns.

b. Based upon the unadjusted trial balance, determine the net income or net loss.

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

Select the correct answer. sarah works in a coffee house where she is responsible for keying in customer orders. a customer orders snacks and coffee, but later, cancels th snacks, saying she wants only coffee. at the end of the day, sarah finds that there is a mismatch in the snack items ordered. which term suggest data has been violated? a. security b. integrity c. adding d. reliability e. reporting

Answers: 3

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

Business, 22.06.2019 22:00

As a general rule, when accountants calculate profit they account for explicit costs but usually ignorea. certain outlays of money by the firm.b. implicit costs.c. operating costs.d. fixed costs.

Answers: 2

You know the right answer?

National Park Tours Co. is a travel agency.

The nine transactions recorded by National Park Tours d...

Questions

English, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Chemistry, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Mathematics, 25.03.2021 05:50

Chemistry, 25.03.2021 05:50

History, 25.03.2021 05:50

Chemistry, 25.03.2021 05:50

Biology, 25.03.2021 05:50