Business, 19.06.2020 02:57 shakira11harvey6

Ignacio, Inc., had after-tax operating income last year of $1,197,000. Three sources of financing were used by the company: $2 million of mortgage bonds paying 4 percent interest, $4 million of unsecured bonds paying 6 percent interest, and $9 million in common stock, which was considered to be relatively risky (with a risk premium of 8 percent). The rate on long-term treasuries is 3 percent. Ignacio, Inc., pays a marginal tax rate of 30 percent.

Required:

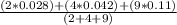

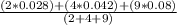

1. Calculate the after-tax cost of each method of financing. Enter your answers as decimal values rounded to three places. For example, 4.36% would be entered as ".044".

Mortgage bonds

Unsecured bonds

Common stock

2. Calculate the weighted average cost of capital for Ignacio, Inc. Round intermediate calculations to four decimal places. Round your final answer to four decimal places before converting to a percentage. For example, .06349 would be rounded to .0635 and entered as "6.35" percent.

%

Calculate the total dollar amount of capital employed for Ignacio, Inc.

$

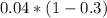

3. Calculate economic value added (EVA) for Ignacio, Inc., for last year. If the EVA is negative, enter your answer as a negative amount.

$

Is the company creating or destroying wealth?

Destroying

4. What if Ignacio, Inc., had common stock which was less risky than other stocks and commanded a risk premium of 5 percent? How would that affect the weighted average cost of capital?

Lower

What is the new EVA? In your calculations, round weighted average percentage cost of capital to four decimal places. If the EVA is negative, enter your answer as a negative amount.

$

Answers: 3

Another question on Business

Business, 22.06.2019 08:20

How much does a neurosurgeon can make most in canada? give me answer in candian dollar

Answers: 1

Business, 22.06.2019 12:20

Bdj co. wants to issue new 22-year bonds for some much-needed expansion projects. the company currently has 9.2 percent coupon bonds on the market that sell for $1,132, make semiannual payments, have a $1,000 par value, and mature in 22 years. what coupon rate should the company set on its new bonds if it wants them to sell at par?

Answers: 3

Business, 22.06.2019 20:00

Later movers do not face: entrenched competitors. reduced uncertainty over technologies. high growth markets. lower market uncertainty.

Answers: 3

Business, 22.06.2019 22:50

What is one of the advantages of getting a government-sponsored mortgage instead of a conventional mortgage

Answers: 1

You know the right answer?

Ignacio, Inc., had after-tax operating income last year of $1,197,000. Three sources of financing we...

Questions

Mathematics, 03.06.2021 08:50

Chemistry, 03.06.2021 08:50

Mathematics, 03.06.2021 08:50

Mathematics, 03.06.2021 08:50

Mathematics, 03.06.2021 08:50

Physics, 03.06.2021 08:50

English, 03.06.2021 08:50

History, 03.06.2021 08:50

Mathematics, 03.06.2021 08:50

English, 03.06.2021 08:50

=

=

=

=