Business, 14.06.2020 02:57 victoriay3

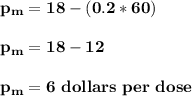

The biotech company Olderna has developed a new coronovirus vaccine it calls bug-b-gone or BBG. Unfortunately, it requires a fermentation process involving iguana eggs, making the marginal cost of the vaccine quite high. The cost function for doses of BBG is C(q) = 5,000 + 0.1q2 (where q is millions of doses). Demand for the vaccine in the US is projected to be D(p) = 90 - 5p, again in millions of doses. That means inverse demand, p(Q) = 18 - 0.2 Q. Part 1. Assume Oderna has a patent on the vaccine? How many (million) doses should it produce if it is maximizing profits from BBG? It should produce q = million doses. Part 2. What is the producer surplus of Olderna at the monopoly price and quantity? The PS will be million.

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

Atax on the sellers of coffee will a. increase the price of coffee paid by buyers, increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. b. increase the price of coffee paid by buyers, increase the e ffective price of coffee received by sellers, and decrease the equilibrium quantity of coffee. c. increase the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. d. increa se the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

Answers: 3

Business, 22.06.2019 15:00

Oerstman, inc. uses a standard costing system and develops its overhead rates from the current annual budget.the budget is based on an expected annual output of 120,000 units requiring 480,000 direct labor hours.(practical capacity is 500,000 hours)annual budgeted overhead costs total $772,800, of which $556,800 is fixed overhead.a total of 119,300 units, using 478,000 direct labor hours, were produced during the year.actual variable overhead costs for the year were $260,400 and actual fixed overhead costs were $555,450.required: 1. compute the fixed overhead spending variance and indicate if favorable or unfavorable.2. compute the fixed overhead volume variance and indicate if favorable or unfavorable.

Answers: 3

Business, 22.06.2019 15:20

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 17:40

Because the demand for wheat tends to be inelastic. true or false

Answers: 1

You know the right answer?

The biotech company Olderna has developed a new coronovirus vaccine it calls bug-b-gone or BBG. Unfo...

Questions

Computers and Technology, 07.09.2020 02:01

English, 07.09.2020 02:01

History, 07.09.2020 02:01

Physics, 07.09.2020 02:01

Mathematics, 07.09.2020 02:01

History, 07.09.2020 02:01

Mathematics, 07.09.2020 02:01

Mathematics, 07.09.2020 02:01

Mathematics, 07.09.2020 02:01

Computers and Technology, 07.09.2020 02:01

English, 07.09.2020 02:01

Biology, 07.09.2020 02:01

Engineering, 07.09.2020 02:01

Mathematics, 07.09.2020 02:01