Business, 03.06.2020 00:59 hawleyemily

In late December you​ decide, for tax​ purposes, to sell a losing position that you hold in​ Twitter, which is listed on the​ NYSE, so that you can capture the loss and use it to offset some capital​ gains, thus reducing your taxes for the current year.​ However, since you still believe that Twitter is a good​ long-term investment, you wish to buy back your position in February the following year. To get this done you call your Charles Schwab brokerage account manager and request that he immediately sell your 1 comma 200 shares of Twitter and then in early February buy them back. Charles Schwab charges a commission of ​$4.95 for online stock trades and for​ broker-assisted trades there is an additional ​$25 service​ charge, so the total commission is ​$29.95.

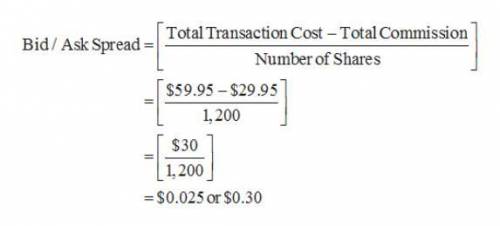

a. Suppose that your total transaction costs for selling the 1,400 shares of Twitter in December were $59.95. What was the bid/ask spread for Twitter at the time your trade was executed?

b. Given that Twitter is listed on the NYSE, do your total transaction costs for December seem reasonable? Explain why or why not.

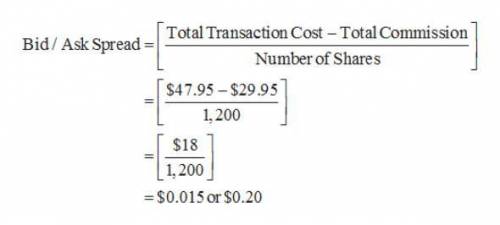

c. When your February statement arrives in the mail, you see that your total transaction costs for buying the 1,400 shares of Twitter were $47.95. What was the bid/ask spread for Twitter at the time your trade was executed?

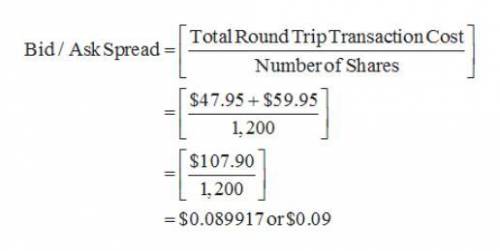

d. What are your total round-trip transaction costs for both selling and buying the shares, and what could you have done differently to reduce the total costs?

Answers: 2

Another question on Business

Business, 21.06.2019 19:00

Minolta inc. is considering a project that has the following cash flow and wacc data. what is the project's mirr? note that a project's projected mirr can be less than the wacc (and even negative), in which case it will be rejected. wacc: 10.00% year 0 1 2 3 4 cash flows -$850 300 $320 $340 $360

Answers: 3

Business, 22.06.2019 03:00

What is the relationship between marginal external cost, marginal social cost, and marginal private cost? a. marginal social cost equals marginal private cost plus marginal external cost. b. marginal private cost plus marginal social cost equals marginal external cost. c. marginal social cost plus marginal external cost equals marginal private cost. d. marginal external cost equals marginal private cost minus marginal social cost. marginal external cost a. is expressed in dollars, so it is not an opportunity cost b. is an opportunity cost borne by someone other than the producer c. is equal to two times the marginal private cost d. is a convenient economics concept that is not real

Answers: 3

Business, 22.06.2019 07:30

Which of the following best describes why you need to establish goals for your program?

Answers: 3

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

You know the right answer?

In late December you​ decide, for tax​ purposes, to sell a losing position that you hold in​ T...

Questions

Mathematics, 08.03.2020 06:39

Mathematics, 08.03.2020 06:43

Mathematics, 08.03.2020 06:46

Mathematics, 08.03.2020 06:47

Mathematics, 08.03.2020 06:48

Business, 08.03.2020 06:48

History, 08.03.2020 06:49

English, 08.03.2020 06:49