Business, 02.06.2020 11:58 irenemonte

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows:

Sales $ 6,200,000

Variable costs (50% of sales) 3,100,000

Fixed costs 1,920,000

Earnings before interest and taxes (EBIT) $ 1,180,000

Interest (10% cost) 440,000

Earnings before taxes (EBT) $ 740,000

Tax (30%) 222,000

Earnings after taxes (EAT) $ 518,000

Shares of common stock 320,000

Earnings per share $ 1.62

The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $3.2 million in additional financing. His investment banker has laid out three plans for him to consider:

Sell $3.2 million of debt at 14 percent.

Sell $3.2 million of common stock at $20 per share.

Sell $1.60 million of debt at 13 percent and $1.60 million of common stock at $25 per share.

Variable costs are expected to stay at 50 percent of sales, while fixed expenses will increase to $2,420,000 per year. Delsing is not sure how much this expansion will add to sales, but he estimates that sales will rise by $1.60 million per year for the next five years.

Delsing is interested in a thorough analysis of his expansion plans and methods of financing. He would like you to analyze the following:

Required:

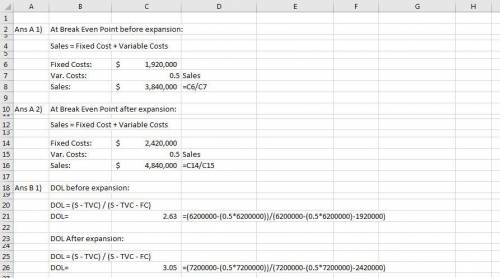

a. The break-even point for operating expenses before and after expansion (in sales dollars). (Enter your answers in dollars not in millions, i. e, $1,234,567.)

b. The degree of operating leverage before and after expansion. Assume sales of $6.2 million before expansion and $7.2 million after expansion. Use the formula: DOL = (S − TVC) / (S − TVC − FC). (Round your answers to 2 decimal places.)

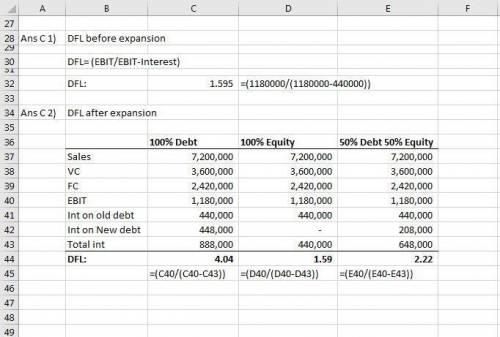

c-1. The degree of financial leverage before expansion. (Round your answers to 2 decimal places.)

c-2. The degree of financial leverage for all three methods after expansion. Assume sales of $7.2 million for this question. (Round your answers to 2 decimal places.)

d. Compute EPS under all three methods of financing the expansion at $7.2 million in sales (first year) and $10.1 million in sales (last year). (Round your answers to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

Atax on the sellers of coffee will a. increase the price of coffee paid by buyers, increase the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. b. increase the price of coffee paid by buyers, increase the e ffective price of coffee received by sellers, and decrease the equilibrium quantity of coffee. c. increase the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and increase the equilibrium quantity of coffee. d. increa se the price of coffee paid by buyers, decrease the effective price of coffee received by sellers, and decrease the equilibrium quantity of coffee.

Answers: 3

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 15:30

In 2015, lori assigned a paid-up whole life insurance policy to an irrevocable life insurance trust (ilit) for the benefit of her three children. the ilit contained a crummey provision for the benefit of each child. at the time of the transfer, the whole life insurance policy was valued at $200,000, and since lori had not made any other taxable gifts during her lifetime, she did not owe any gift tax. lori died in 2016, and the face value of the whole life insurance policy of $2,000,000 was paid to the ilit. regarding this transfer, how much is included in lori’s gross estate at her death?

Answers: 1

You know the right answer?

Delsing Canning Company is considering an expansion of its facilities. Its current income statement...

Questions

Mathematics, 24.04.2021 01:00

Chemistry, 24.04.2021 01:00

Mathematics, 24.04.2021 01:00

Business, 24.04.2021 01:00

French, 24.04.2021 01:00

English, 24.04.2021 01:00

Mathematics, 24.04.2021 01:00

Mathematics, 24.04.2021 01:00

Spanish, 24.04.2021 01:00