Business, 28.05.2020 05:02 hairyears3394

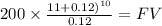

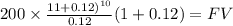

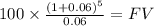

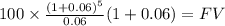

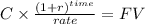

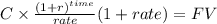

Find the future values of these ordinary annuities. Compounding occurs once a year. Round your answers to the nearest cent. $200 per year for 10 years at 12%. $ 621.17 $100 per year for 5 years at 6%. $ $1,000 per year for 2 years at 0%. $ Rework previous parts assuming that they are annuities due. Round your answers to the nearest cent. $200 per year for 10 years at 12%. $ $100 per year for 5 years at 6%. $ $1,000 per year for 2 years at 0%. $

Answers: 3

Another question on Business

Business, 22.06.2019 02:50

Wren pork company uses the value basis of allocating joint costs in its production of pork products. relevant information for the current period follows: product pounds price/lb. loin chops 3,000 $ 5.00 ground 10,000 2.00 ribs 4,000 4.75 bacon 6,000 3.50 the total joint cost for the current period was $43,000. how much of this cost should wren pork allocate to loin chops?

Answers: 1

Business, 22.06.2019 03:00

Which of the following is not a consideration when determining your asset allocation

Answers: 3

Business, 22.06.2019 12:30

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

Business, 22.06.2019 18:50

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

You know the right answer?

Find the future values of these ordinary annuities. Compounding occurs once a year. Round your answe...

Questions

Mathematics, 04.04.2020 06:52

History, 04.04.2020 06:52

Biology, 04.04.2020 06:52

Mathematics, 04.04.2020 06:52

Mathematics, 04.04.2020 06:52

Mathematics, 04.04.2020 06:52

Mathematics, 04.04.2020 06:52

Mathematics, 04.04.2020 06:52

Mathematics, 04.04.2020 06:52

(annuity-due)

(annuity-due)