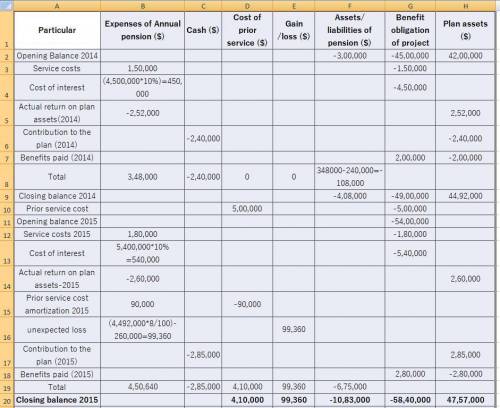

On January 1, 2014, Harrington Company has the following defined benefit pension plan balances.

Projected benefit obligation $4,500,000

Fair value of plan assets $4,200,000

The interest (settlement) rate applicable to the plan is 10%. On January 1, 2015, the company amends its pension agreement so that prior service costs of $500,000 are created. Other data related to the pension plan are as follows.

2014 2015

Service cost $150,000 $180,000

Prior service cost amortization -0- 90,000

Contributions (funding) to the plan 240,000 285,000

Benefits paid 200,000 280,000

Actual return on plan assets 252,000 260,000

Expected rate of return on assets 6% 8%

Instructions

(a) Prepare a pension worksheet for the pension plan for 2014 and 2015.

(b) For 2015, prepare the journal entry to record pension-related amounts.

Answers: 3

Another question on Business

Business, 22.06.2019 01:30

Elliott company produces large quantities of a standardized product. the following information is available for its production activities for march. units costs beginning work in process inventory 2,500 beginning work in process inventory started 25,000 direct materials $ 3,725 ending work in process inventory 5,000 conversion 11,580 $ 15,305 status of ending work in process inventory direct materials added 185,750 materials—percent complete 100 % direct labor added 182,375 conversion—percent complete 30 % overhead applied (140% of direct labor) 255,325 total costs to account for $ 638,755 ending work in process inventory $ 62,530 prepare a process cost summary report for this company, showing costs charged to production, unit cost information, equivalent units of production, cost per eup, and its cost assignment and reconciliation. use the weighted-average method. (round "cost per eup" to 2 decimal places.)

Answers: 1

Business, 22.06.2019 02:20

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 06:30

"in my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said wim niewindt, managing director of antilles refining, n.v., of aruba. "at a price of $21 per drum, we would be paying $4.70 less than it costs us to manufacture the drums in our own plant. since we use 70,000 drums a year, that would be an annual cost savings of $329,000." antilles refining's current cost to manufacture one drum is given below (based on 70,000 drums per year):

Answers: 1

You know the right answer?

On January 1, 2014, Harrington Company has the following defined benefit pension plan balances.

Questions

Mathematics, 22.10.2019 09:00

Mathematics, 22.10.2019 09:00

Spanish, 22.10.2019 09:00

History, 22.10.2019 09:00

Biology, 22.10.2019 09:00

Health, 22.10.2019 09:00

Mathematics, 22.10.2019 09:00

Geography, 22.10.2019 09:00

Mathematics, 22.10.2019 09:00

Mathematics, 22.10.2019 09:00