Business, 27.05.2020 10:57 jamesmcfarland

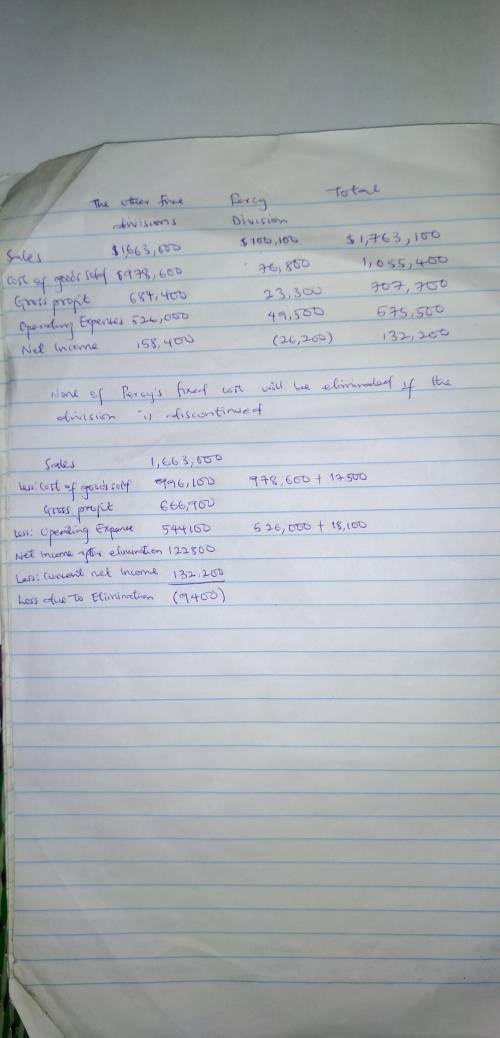

Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance of Dunn Company’s six divisions. Veronica made the following presentation to Dunn’s board of directors and suggested the Percy Division be eliminated. "If the Percy Division is eliminated," she said, "our total profits would increase by $26,200." The Other Five Divisions Percy Division Total Sales $1,663,000 $100,100 $1,763,100 Cost of goods sold 978,600 76,800 1,055,400 Gross profit 684,400 23,300 707,700 Operating expenses 526,000 49,500 575,500 Net income $158,400 $ (26,200 ) $132,200

In the Percy Division, the cost of goods sold is $59,300 variable and $17,500 fixed, and operating expenses are $31,400 variable and $18,100 fixed. None of the Percy Division’s fixed costs will be eliminated if the division is discontinued.

Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your answer.

Answers: 1

Another question on Business

Business, 21.06.2019 15:50

Aceramics manufacturer sold cups last year for $7.50 each. variable costs of manufacturing were $2.25 per unit. the company needed to sell 20,000 cups to break even. net income was $5,040. this year, the company expects the price per cup to be $9.00; variable manufacturing costs to increase 33.3%; and fixed costs to increase 10%. how many cups (rounded) does the company need to sell this year to break even?

Answers: 2

Business, 22.06.2019 06:00

For 2018, rahal's auto parts estimates bad debt expense at 1% of credit sales. the company reported accounts receivable and an allowance for uncollectible accounts of $86,500 and $2,100, respectively, at december 31, 2017. during 2018, rahal's credit sales and collections were $404,000 and $408,000, respectively, and $2,340 in accounts receivable were written off.rahal's accounts receivable at december 31, 2018, are:

Answers: 2

Business, 22.06.2019 22:40

Rolston music company is considering the sale of a new sound board used in recording studios. the new board would sell for $27,200, and the company expects to sell 1,570 per year. the company currently sells 2,070 units of its existing model per year. if the new model is introduced, sales of the existing model will fall to 1,890 units per year. the old board retails for $23,100. variable costs are 57 percent of sales, depreciation on the equipment to produce the new board will be $1,520,000 per year, and fixed costs are $1,420,000 per year.if the tax rate is 35 percent, what is the annual ocf for the project?

Answers: 1

You know the right answer?

Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance o...

Questions

Spanish, 29.06.2019 07:00

Mathematics, 29.06.2019 07:00

Chemistry, 29.06.2019 07:00

Mathematics, 29.06.2019 07:00

Biology, 29.06.2019 07:00

Health, 29.06.2019 07:00

History, 29.06.2019 07:00

Mathematics, 29.06.2019 07:00