Business, 27.05.2020 17:57 wavymoney77yt

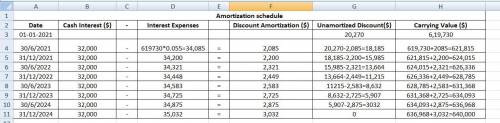

When Patey Pontoons issued 10% bonds on January 1, 2021, with a face amount of $640,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2024 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price of the bonds at January 1, 2021. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2021. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30, 2021. 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31, 2021? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2021? (Ignore income taxes.) 7. Prepare the appropriate journal entries at maturity on December 31, 2024.

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Match each item to check for while reconciling a bank account with the document to which it relates. (there's not just one answer) 1. balancing account statement 2. balancing check register a. nsf fees b. deposits in transit c. interest earned d. bank errors

Answers: 3

Business, 22.06.2019 05:30

Excel allows you to take a lot of data and organize it in one document. what are some of the features you can use to clarify, emphasize, and differentiate your data?

Answers: 2

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 19:00

The market demand curve for a popular teen magazine is given by q = 80 - 10p where p is the magazine price in dollars per issue and q is the weekly magazine circulation in units of 10,000. if the circulation is 400,000 per week at the current price, what is the consumer surplus for a teen reader with maximum willingness to pay of $3 per issue?

Answers: 1

You know the right answer?

When Patey Pontoons issued 10% bonds on January 1, 2021, with a face amount of $640,000, the market...

Questions

Mathematics, 07.05.2020 22:57

Mathematics, 07.05.2020 22:57

English, 07.05.2020 22:57

Health, 07.05.2020 22:57

English, 07.05.2020 22:57

Mathematics, 07.05.2020 22:57

Mathematics, 07.05.2020 22:57

Chemistry, 07.05.2020 22:57

Mathematics, 07.05.2020 22:57

History, 07.05.2020 22:57