Business, 19.05.2020 15:57 zanaplen27

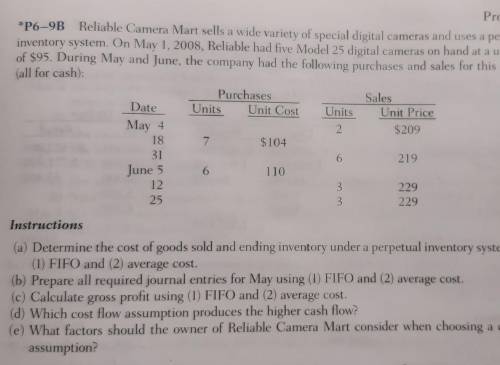

*P6-9B Reliable Camera Mart sells a wide variety of special digital cameras and uses a perpetual

inventory system. On May 1, 2008, Reliable had five Model 25 digital cameras on hand at a unit cost

of $95. During May and June, the company had the following purchases and sales for this camera (all for cash):

see image

Instructions

(a) Determine the cost of goods sold and ending inventory under a perpetual inventory system using

(1) FIFO and (2) average cost.

(b) Prepare all required journal entries for May using (1) FIFO and (2) average cost.

(c) Calculate gross profit using (1) FIFO and (2) average cost.

(d) Which cost flow assumption produces the higher cash flow?

(e) What factors should the owner of Reliable Camera Mart consider when choosing a cost flow

assumption?

Answers: 3

Another question on Business

Business, 21.06.2019 17:40

Find the expected net profit of an insurance company on a health-insurance policy if: the probability of a $5000 claim is 20%; the probability of a $1000 claim is 60%; the probability of a $20,000 claim is 10%, and the probability of no claim is 10%. the company charges $4000 for this coverage. interpret your answer.

Answers: 3

Business, 21.06.2019 22:20

Suppose a ceiling fan manufacturer has the total cost function c(x) = 48x + 1485 and the total revenue function r(x) = 75x. (a) what is the equation of the profit function p(x) for this commodity? p(x) = (b) what is the profit on 35 units? p(35) = interpret your result. the total costs are less than the revenue. the total costs are more than the revenue. the total costs are exactly the same as the revenue. (c) how many fans must be sold to avoid losing money? fans

Answers: 1

Business, 22.06.2019 10:50

Melissa is a very generous single woman. before this year, she had given over $11,400,000 in taxable gifts over the years and has completely exhausted her applicable credit amount. in the current year, melissa gave her daughter riley $100,000 and promptly filed her gift tax return. melissa did not make any other gifts this year. how much gift tax must riley pay the irs because of this transaction?

Answers: 2

Business, 22.06.2019 12:00

In the united states, one worker can produce 10 tons of steel per day or 20 tons of chemicals per day. in the united kingdom, one worker can produce 5 tons of steel per day or 15 tons of chemicals per day. the united kingdom has a comparative advantage in the production of:

Answers: 2

You know the right answer?

*P6-9B Reliable Camera Mart sells a wide variety of special digital cameras and uses a perpetual

Questions

English, 17.02.2021 15:20

English, 17.02.2021 15:20

Mathematics, 17.02.2021 15:20

English, 17.02.2021 15:20

Mathematics, 17.02.2021 15:20

Health, 17.02.2021 15:20

Mathematics, 17.02.2021 15:20

Mathematics, 17.02.2021 15:20

History, 17.02.2021 15:20

Mathematics, 17.02.2021 15:20

Mathematics, 17.02.2021 15:20

Mathematics, 17.02.2021 15:20

Social Studies, 17.02.2021 15:20