Business, 19.05.2020 15:18 savageyvens

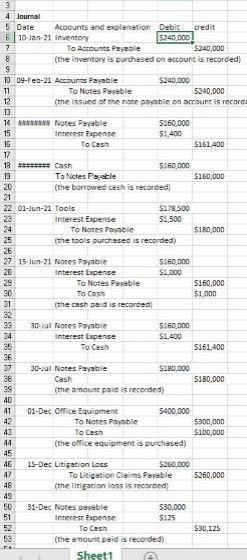

The following items were selected from among the transactions completed by O’Donnel Co. during the current year: Jan. 10. Purchased merchandise on account from Laine Co., $240,000, terms n/30. Feb. 9. Issued a 30-day, 4% note for $240,000 to Laine Co., on the account. Mar. 11. Paid Laine Co. the amount owed on the note of February 9. May 1. Borrowed $160,000 from Tabata Bank, issuing a 45-day, 5% note. June 1. Purchased tools by issuing a $180,000, 60-day note to Gibala Co., which discounted the note at the rate of 5%. 15. Paid Tabata Bank the interest due on the note of May 1 and renewed the loan by issuing a new 45-day, 7% note for $160,000. (Journalize both the debit and credit to the notes payable account.) July 30. Paid Tabata Bank the amount due on the note of June 15. 30. Paid Gibala Co. the amount due on the note of June 1. Dec. 1. Purchased office equipment from Warick Co. for $400,000, paying $100,000 and issuing a series of ten 5% notes for $30,000 each, coming due at 30-day intervals. 15. Settled a product liability lawsuit with a customer for $260,000, payable in January. O’Donnel accrued the loss in a litigation claims payable account. 31. Paid the amount due to Warick Co. on the first note in the series issued on December 1

1. Journalize the transactions. Refer to the Chart of Accounts for the exact wording of account titles. Assume a 360-day year.

2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):

a. Product warranty cost, $23,000.

b. Interest in the nine remaining notes owed to Warick Co. Assumes a 360-day year.

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Insurance companies have internal controls in place to protect assets, monitor the accuracy of accounting records and encourage operational efficiencies and adherence to policies. these internal controls are generally of two types: administrative controls and accounting controls. administrative controls are the policies and procedures that guide the daily actions of employees. accounting controls are the policies and procedures that delineate authorizations of financial transactions that are done, safeguard assets, and provide reports on the company’s financial status in a reliable and timely manner. internal controls should include both preventative and detective controls. the purpose of preventative controls is to stop problems and errors before they occur. detective controls identify problems after they have occurred. preventative controls are usually more effective at reducing problems, but they also tend to be more expensive. internal controls must be flexible to adjust for changes in laws and regulations in addition to adding new products or modifying current ones. companies must also do regular analyses to ensure that the benefits of implementing the controls are worth their costs. when concerned about paying unwarranted insurance claims which type of control would be useful?

Answers: 2

Business, 22.06.2019 20:00

What is the difference between total utility and marginal utility? a. marginal utility is subject to the law of diminishing marginal utility while total utility is not. b. total utility represents the consumer optimum while marginal utility gives the total utility per dollar spent on the last unit. c. total utility is the total amount of satisfaction derived from consuming a certain amount of a good while marginal utility is the additional satisfaction gained from consuming an additional unit of the good. d. marginal utility represents the consumer optimum while total utility gives the total utility per dollar spent on the last unit.

Answers: 3

Business, 22.06.2019 23:10

R& m chatelaine is one of the largest tax-preparation firms in the united states. it wants to acquire the tax experts, a smaller rival. after the merger, chatelaine will be one of the two largest income-tax preparers in the u.s. market. what should chatelaine include in its acquisition plans? it should refocus its attention from the national to the international market. in addition to acquiring the tax experts, it should also determine the best way to drive independent "mom and pop" tax preparers out of business. chatelaine will need to explain to the federal trade commission how the acquisition will not result in an increase in prices for consumers. chatelaine should enter a price-based competition with its other major competitor to force it out of business and become a monopoly.

Answers: 3

Business, 23.06.2019 01:00

"consists of larger societal forces that affect how a company engages and serves its customers."

Answers: 1

You know the right answer?

The following items were selected from among the transactions completed by O’Donnel Co. during the c...

Questions

English, 31.03.2020 17:34

History, 31.03.2020 17:34

Mathematics, 31.03.2020 17:34