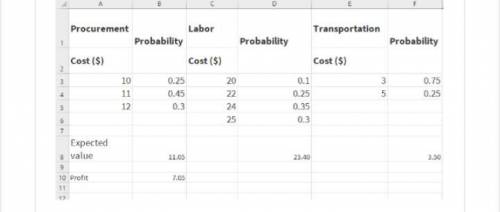

The management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. The selling price for the product will be $45 per unit.

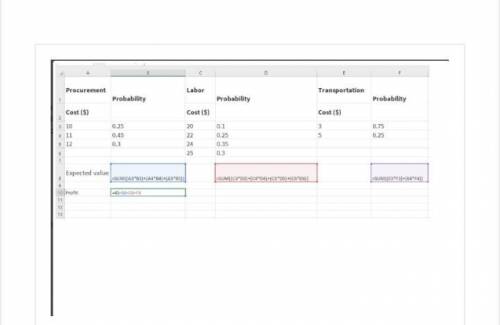

Procurement Probability Labor Probability Transportation Probability

10 0.25 20 0.10 3 0.75

11 0.45 22 0.25 5 0.25

12 0.30 24 0.35

25 0.30

a. Compute profit per unit for the base-case, worst-case, and best-case scenarios.

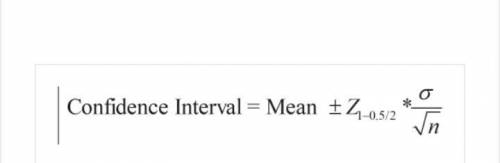

b. Construct a simulation model to estimate the mean profit per unit.

c. Why is the simulation approach to risk analysis preferable to generating a variety of what-if scenarios?

d. Management believes the project may not be sustainable if the profit per unit is less than $5. Use simulation to estimate the probability the profit per unit will be less than $5.

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

Consider a two-firm industry. firm 1 (the incumbent) chooses a level of output q1. firm 2 (the potential entrant) observes q1 and then chooses its level of output q2. the demand for the product is p = 100 - q, where q is the total output sold by the two firms which equals q1 +q2. assume that the marginal cost of each firm is zero. a) find the subgame perfect equilibrium levels of q1 and q2 keeping in mind that firm 1 chooses q1 first and firm 2 observes q1 and chooses its q2. find the profits of the two firms-? 1 and ? 2- in the subgame perfect equilibrium. how do these numbers differ from the cournot equilibrium? b) for what level of q1 would firm 2 be deterred from entering? would a rational firm 1 have an incentive to choose this level of q1? which entry condition does this market have: blockaded, deterred, or accommodated? now suppose that firm 2 has to incur a fixed cost of entry, f > 0. c) for what values of f will entry be blockaded? d) find out the entry deterring level of q1, denoted by q1b, as a function of f. next, derive the expression for firm 1

Answers: 1

Business, 22.06.2019 05:00

Identify an organization with the low-total-cost value proposition and suggest at least two possible measures within each of the four balanced scorecard perspectives.

Answers: 3

Business, 22.06.2019 10:40

Parks corporation is considering an investment proposal in which a working capital investment of $10,000 would be required. the investment would provide cash inflows of $2,000 per year for six years. the working capital would be released for use elsewhere when the project is completed. if the company's discount rate is 10%, the investment's net present value is closest to (ignore income taxes) ?

Answers: 1

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

You know the right answer?

The management of Brinkley Corporation is interested in using simulation to estimate the profit per...

Questions

Mathematics, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

History, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

English, 12.11.2020 14:00

History, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

Geography, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

Mathematics, 12.11.2020 14:00

English, 12.11.2020 14:00