Business, 05.05.2020 00:35 jairopanda8

Assume the following annual financial information for Kelli (age 30):

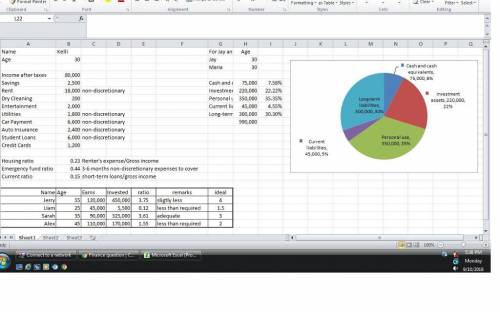

Income (after taxes) : $80,000

Savings : $2,500

Rent: $18,000

Dry Cleaning $200

Entertainment $2,000

Utilities $1,800

Car Payment $6,600

Auto Insurance $2,400

Student Loans $6,000

Credit Cards $1,200

Utilizing targeted benchmarks, which of the following statements is FALSE regarding Kelli’s financial situation?

a. Kelli's Housing Ratio 1 is adequate.

b. Kelli's emergency fund is adequate.

c. Kelli's Housing Ratio 2 is deficient.

d. Kelli's current ratio is less than 1

Utilizing investment assets to gross pay benchmarks, which of the following individuals is likely on target with their investment assets?

a. Jery age 55 earns $120,000 a year and has invested assets of $450,000.

b. Liam age 25 earns $45,000 a year and has invested assets of $5,500.

c. Sarah age 35 earns $90,000 a year and has invested assets of $325,000.

d. Alex age 45 earns $110,000 a year and has invested assets of $170,000.

Use the following financial information for Jay (age 30) and Maria (age 30) Handberger:

a. Cash and Cash Equivalents: $75,000

b. Investment Assets: $220,000

c. Personal Use Assets: $350,000

d. Current Liabilities: $45,000

e. Long-Term iabilities: $300,000

Before your next meeting with the Handberger's, you create a pie chart to visually depict their current balance sheet. Utilizing targeted benchmarks, which of the following statements are you most likely to make during your next meetang?

a. "Your investment assets make up 34% of your asset pie chart, which is too low for your age group.

b. "Given your assets and liabilities, your net worth is appropriate for your age group.

c. "Relative to the rest of your assets, your cash and cash equivalents are too low for your age group.

d. "Compared to your net worth and current liabilities, your long-term liabilities are excessive for your age group.

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

Northington, inc. is preparing the company's statement of cash flows for the fiscal year just ended. using the following information, determine the amount of cash flows from operating activities using the indirect method: net income$182,000gain on the sale of equipment12,300proceeds from the sale of equipment92,300depreciation expense—equipment50,000payment of bonds at maturity100,000purchase of land200,000issuance of common stock300,000increase in merchandise inventory35,400decrease in accounts receivable28,800increase in accounts payable23,700payment of cash dividends32,000 $189,400.$332,200.$236,800.$261,400.$186,800.

Answers: 2

Business, 22.06.2019 13:30

The fiscal 2016 financial statements of nike inc. shows average net operating assets (noa) of $8,450 million, average net nonoperating obligations (nno) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million. the company's 2016 financial leverage (flev) is: select one: a. (0.477) b. (0.559 c. (0.323) d. (0.447) e. there is not enough information to determine the ratio.

Answers: 2

Business, 22.06.2019 16:00

Advanced enterprises reports year-end information from 2018 as follows: sales (160,250 units) $968,000 cost of goods sold 641,000 gross margin 327,000 operating expenses 263,000 operating income $64,000 advanced is developing the 2019 budget. in 2019 the company would like to increase selling prices by 14.5%, and as a result expects a decrease in sales volume of 9%. all other operating expenses are expected to remain constant. assume that cost of goods sold is a variable cost and that operating expenses are a fixed cost. should advanced increase the selling price in 2019?

Answers: 3

Business, 22.06.2019 19:50

At the beginning of 2014, winston corporation issued 10% bonds with a face value of $2,000,000. these bonds mature in five years, and interest is paid semiannually on june 30 and december 31. the bonds were sold for $1,852,800 to yield 12%. winston uses a calendar-year reporting period. using the effective-interest method of amortization, what amount of interest expense should be reported for 2014? (round your answer to the nearest dollar.)

Answers: 2

You know the right answer?

Assume the following annual financial information for Kelli (age 30):

Income (after tax...

Income (after tax...

Questions

Advanced Placement (AP), 30.08.2020 01:01

Mathematics, 30.08.2020 01:01

Computers and Technology, 30.08.2020 01:01

Mathematics, 30.08.2020 01:01

Mathematics, 30.08.2020 01:01

Computers and Technology, 30.08.2020 01:01

Biology, 30.08.2020 01:01

Chemistry, 30.08.2020 01:01

History, 30.08.2020 01:01