Business, 05.05.2020 14:55 bvghchg4401

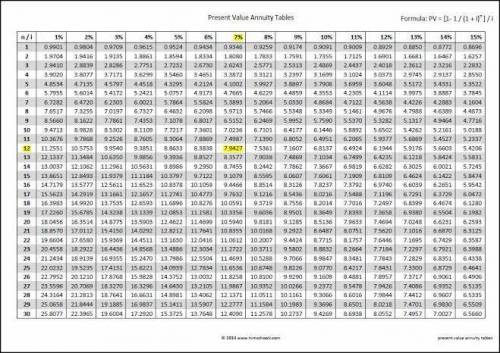

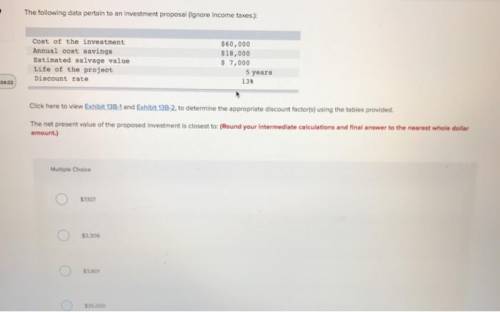

He following data pertain to an investment proposal (Ignore income taxes.): Cost of the investment $ 60,000 Annual cost savings $ 18,000 Estimated salvage value $ 7,000 Life of the project 5 years Discount rate 13 % Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the proposed investment is closest to:

Answers: 1

Another question on Business

Business, 22.06.2019 06:40

After the 2008 recession, the amount of reserves in the us banking system increased. because of federal reserve actions, required reserves increased from $44 billion to $60 billion. however, banks started holding more reserves than required. by january 2009, banks were holding $900 billion in excess reserves. the federal reserve started paying interest on the excess reserves that the banks held. what possible impact will these unused reserves have on the economy?

Answers: 1

Business, 22.06.2019 11:30

11. before adding cream to a simmering soup, you need to a. simmer the cream. b. chill the cream. c. strain the cream through cheesecloth. d. allow the cream reach room temperature. student d incorrect which answer is right?

Answers: 2

Business, 22.06.2019 18:30

What historical context does wiesel convey using the allusion of a fiery sky? he compares the sky to hell. the fires from air raids during world war ii the cremation of jews in the concentration camps the outbreak of forest fires from bombs in world war ii

Answers: 1

Business, 23.06.2019 19:30

Under what circumstances might you be protected by the equal credit opportunity act?

Answers: 1

You know the right answer?

He following data pertain to an investment proposal (Ignore income taxes.): Cost of the investment $...

Questions

History, 31.01.2020 14:47

English, 31.01.2020 14:47

Mathematics, 31.01.2020 14:47

English, 31.01.2020 14:47

Mathematics, 31.01.2020 14:47

Social Studies, 31.01.2020 14:47

Mathematics, 31.01.2020 14:47

History, 31.01.2020 14:47

Mathematics, 31.01.2020 14:47

History, 31.01.2020 14:47