Business, 04.05.2020 22:35 jordynp5768

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $15,800. They expect to use the Suburban for five years and then sell the vehicle for $6,400. The following expenditures related to the vehicle were also made on July 1, 2022: The company pays $2,750 to GEICO for a one-year insurance policy. The company spends an extra $6,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. An additional $2,950 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2022, the company pays $2,300 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter.

Required:

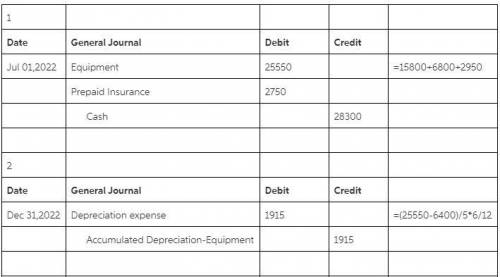

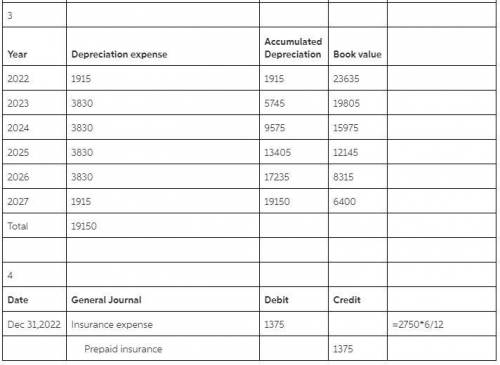

a. Record the expenditures related to the vehicle on July 1, 2022. Note: The capitalized cost of the vehicle is recorded in the Equipment account.

b. Record the expenditure related to vehicle maintenance on October 22, 2022.

c. Record the depreciation for vehicle purchased. Use straight-line depreciation.

d. Record the expiration of prepaid insurance.

e. Record the closing entry for revenue accounts.

f. Record the closing entry for expense accounts.

Answers: 3

Another question on Business

Business, 21.06.2019 23:00

Which of the following statements is correct? large corporations are taxed more favorably than sole proprietorships. corporate stockholders are exposed to unlimited liability. due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of u.s. businesses (in terms of number of businesses) are organized as corporations. most businesses (by number and total dollar sales) are organized as partnerships or proprietorships because it is easier to set up and operate in one of these forms rather than as a corporation. however, if the business gets very large, it becomes advantageous to convert to a corporation, mainly because corporations have important tax advantages over proprietorships and partnerships. most business (measured by dollar sales) is conducted by corporations in spite of large corporations’ often less favorable tax treatment, due to legal considerations related to ownership transfers and limited liability.

Answers: 3

Business, 22.06.2019 05:30

U.s. internet advertising revenue grew at the rate of r(t) = 0.82t + 1.14 (0 ≤ t ≤ 4) billion dollars/year between 2002 (t = 0) and 2006 (t = 4). the advertising revenue in 2002 was $5.9 billion.† (a) find an expression f(t) giving the advertising revenue in year t.

Answers: 1

Business, 22.06.2019 11:20

In 2000, campbell soup company launched an ad campaign that showed prepubescent boys offering soup to prepubescent girls. the girls declined because they were concerned about their calorie intake. the boys explained that “lots of campbell’s soups are low in calories,” which made them ok for the girls to eat. the ads were pulled after parents expressed concern. why were parents worried? i

Answers: 2

Business, 22.06.2019 16:40

Based on what you learned about time management which of these statements are true

Answers: 1

You know the right answer?

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies....

Questions

Mathematics, 29.07.2021 16:50

History, 29.07.2021 16:50

Arts, 29.07.2021 16:50

Advanced Placement (AP), 29.07.2021 16:50

Biology, 29.07.2021 16:50

Mathematics, 29.07.2021 16:50

Mathematics, 29.07.2021 16:50

History, 29.07.2021 16:50

English, 29.07.2021 16:50

Mathematics, 29.07.2021 16:50

Mathematics, 29.07.2021 16:50

Arts, 29.07.2021 16:50

Mathematics, 29.07.2021 16:50

Mathematics, 29.07.2021 16:50