Business, 05.05.2020 10:50 loulou6166

On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:

Accounts Debit Credit

Cash $ 25,600

Accounts Receivable 47,200

Allowance for

Uncollectible Accounts $ 4,700

Inventory 20,500

Land 51,000

Equipment 17,500

Accumulated Depreciation 2,000

Accounts Payable 29,000

Notes Payable

(6%, due April 1, 2022) 55,000

Common Stock 40,000

Retained Earnings 31,100

Totals $ 161,800 $ 161,800

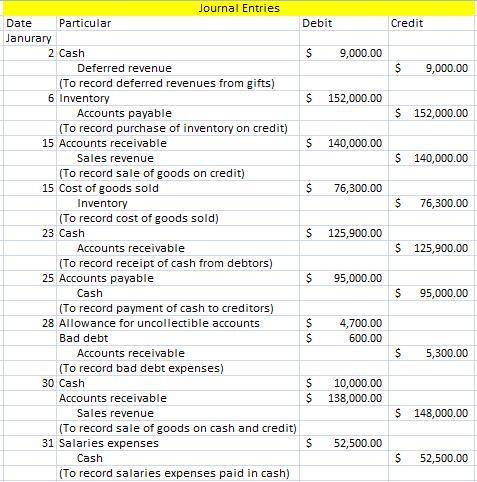

During January 2021, the following transactions occur:

January 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date.

January 6 Purchase additional inventory on account, $152,000.

January 15 Firework sales for the first half of the month total $140,000. All of these sales are on account. The cost of the units sold is $76,300.

January 23 Receive $125,900 from customers on accounts receivable.

January 25 Pay $95,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $5,300.

January 30 Firework sales for the second half of the month total $148,000. Sales include $10,000 for cash and $138,000 on account. The cost of the units sold is $82,000.

January 31 Pay cash for monthly salaries, $52,500.

1. Record each of the transactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

Answers: 2

Another question on Business

Business, 22.06.2019 02:40

The following accounts are denominated in pesos as of december 31, 2015. for reporting purposes, these amounts need to be stated in u.s. dollars. for each balance, indicate the exchange rate that would be used if a translation is made under the current rate method. then, again for each account, provide the exchange rate that would be necessary if a remeasurement is being made using the temporal method. the company was started in 2000. the buildings were acquired in 2002 and the patents in 2003. (round your answers to 2 decimal places.) exchange rates for 1 peso are as follows: 2000 1 peso = $ 0.28 2002 1 = 0.26 2003 1 = 0.25 january 1, 2015 1 = 0.24 april 1, 2015 1 = 0.23 july 1, 2015 1 = 0.22 october 1, 2015 1 = 0.20 december 31, 2015 1 = 0.16 average for 2015 1 = 0.19

Answers: 3

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Business, 23.06.2019 00:00

Wo firms, a and b, each currently dump 50 tons of chemicals into the local river. the government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution dumped into the river. it costs firm a $100 for each ton of pollution that it eliminates before it reaches the river, and it costs firm b $50 for each ton of pollution that it eliminates before it reaches the river. the government gives each firm 20 pollution permits. government officials are not sure whether to allow the firms to buy or sell the pollution permits to each other. what is the total cost of reducing pollution if firms are not allowed to buy and sell pollution permits from each other? what is the total cost of reducing pollution if the firms are allowed to buy and sell permits from each other? a. $3,000; $1,500 b. $4,500; $3,500 c. $4,500; $4,000 d. $4,500; $2,500

Answers: 3

You know the right answer?

On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:

Questions

Physics, 08.02.2021 17:00

Mathematics, 08.02.2021 17:00

Mathematics, 08.02.2021 17:00

Mathematics, 08.02.2021 17:00

Advanced Placement (AP), 08.02.2021 17:00

Mathematics, 08.02.2021 17:00

Mathematics, 08.02.2021 17:00

Mathematics, 08.02.2021 17:00

Physics, 08.02.2021 17:00