Business, 05.05.2020 04:26 lalaokawami0912

You live in a town with 300 adults and 200 children, and you are thinking about putting on a play to entertain your neighbors and make some money. A play has a fixed cost of $1,000, but selling an extra ticket has zero marginal cost.

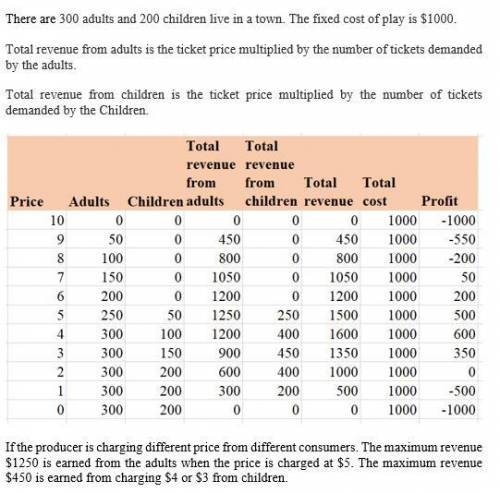

Here are the demand schedules for your two types of customers:

Price Adults Children

(Dollars) (Tickets) (Tickets)

10 0 0

9 50 0

8 100 0

7 150 0

6 200 0

5 250 50

4 300 100

3 300 150

2 300 200

1 300 200

0 300 200

To maximize profit, you would charge for an adult's ticket and for a child's ticket . Total profit, in this case, would be .

The city council passes a law prohibiting you from charging different prices to different customers. Now you set a price of for all tickets, resulting in profit.

Indicate whether each of the following groups of people is better off, worse off, or the same because of the law prohibiting price discrimination.

Group of People Better Off Worse Off Unchanged

Adults

Children

You, the Producer

Suppose the fixed cost of the play were $1,800 rather than $1,000.

Complete the following sentences indicating how this would change your answers to the previous parts.

In the presence of price discrimination, the adult price of a ticket would , and the child price would .

Total profit would to .

If price discrimination were banned and the monopolist continued to produce the play no matter what the profit, the price of a ticket would , and total profit would to .

Answers: 2

Another question on Business

Business, 22.06.2019 09:30

The 39 percent and 38 percent tax rates both represent what is called a tax "bubble." suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $208,000. what would the new 39 percent bubble rate have to be? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places,e.g., 32.16.)

Answers: 3

Business, 22.06.2019 14:30

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

You know the right answer?

You live in a town with 300 adults and 200 children, and you are thinking about putting on a play to...

Questions

English, 18.02.2021 21:30

Computers and Technology, 18.02.2021 21:30

Mathematics, 18.02.2021 21:30