Business, 05.05.2020 04:21 Christiancameron1234

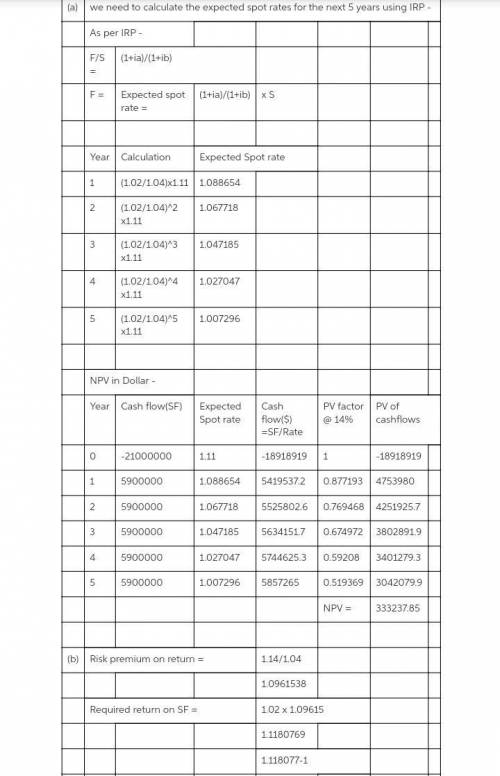

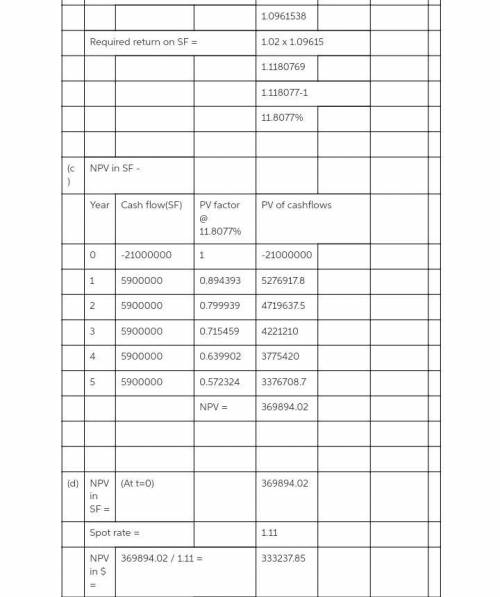

You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost of the expansion would be SF 21 million. The cash flows from the project would be SF 5.9 million per year for the next five years. The dollar required return is 14 percent per year, and the current exchange rate is SF 1.11. The going rate on Eurodollars is 4 percent per year. It is 2 percent per year on Euroswiss.

Use the approximate form of interest rate parity in calculating the expected spot rates.

A) Convert the projected franc flows into dollar flows and calculate the NPV.

B) What is the required return on franc flows?

C) What is the NPV of the project in Swiss francs?

D) What is the NPV in dollars if you convert the franc NPV to dollars?

Answers: 3

Another question on Business

Business, 21.06.2019 18:30

What is product differentiation, and how can it be achieved ? what is product positioning? what conditions would head to head product positioning be appropriate?

Answers: 2

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

Business, 23.06.2019 01:00

Weekly sales at nancy's restaurant total $ 84,000. labor required is 420 hours at a cost of $21,000. raw materials used amount to $40,000. what is the partial measure of productivity for labor hours?

Answers: 1

You know the right answer?

You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost o...

Questions

Mathematics, 27.04.2020 03:18

Biology, 27.04.2020 03:18

History, 27.04.2020 03:18

Biology, 27.04.2020 03:18

Mathematics, 27.04.2020 03:18

Mathematics, 27.04.2020 03:18

Mathematics, 27.04.2020 03:18

Mathematics, 27.04.2020 03:18

Mathematics, 27.04.2020 03:18

Mathematics, 27.04.2020 03:18

Mathematics, 27.04.2020 03:18

English, 27.04.2020 03:18