Business, 05.05.2020 17:18 angelica3752

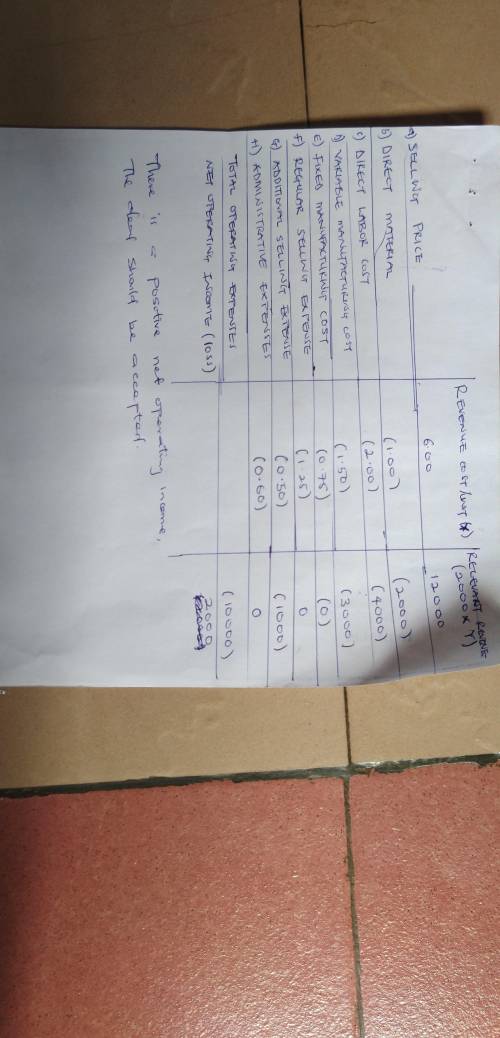

Helix Company has been approached by a new customer to provide 2,000 units of its regular product at a special price of $6 per unit. The regular selling price of the product is $8 per unit. Helix is operating at 75% of its capacity of 10,000 units. Identify whether the following costs are relevant to Helix's decision as to whether to accept the order at the special selling price. No additional fixed manufacturing overhead will be incurred because of this order. The only additional selling expense on this order will be a $0.50 per unit shipping cost. There will be no additional administrative expenses because of this order Calculate the operating income from the order Relevant Not Relevant Relevant Revenues Costs Revenue (cost) per unit a. Selling price b. Direct materials cost C. Direct labor cost d. Variable manufacturing overhead e. Fixed manufacturing overhead f. Regular selling expenses g. Additional selling expenses h. Administrative expenses 6.00 (2.00) (0.75) (0.50) (0.60) 2,000 Total operating income(loss) from special order Based on financial considerations alone, should Helix accept this order at the special price?

Answers: 2

Another question on Business

Business, 22.06.2019 14:20

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

Business, 22.06.2019 15:20

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 19:40

The common stock of ncp paid $1.35 in dividends last year. dividends are expected to grow at an annual rate of 5.30 percent for an indefinite number of years. a. if ncp's current market price is $22.57 per share, what is the stock's expected rate of return? b. if your required rate of return is 7.3 percent, what is the value of the stock for you? c. should you make the investment? a. if ncp's current market price is $22.57 per share, the stock's expected rate of return is

Answers: 3

Business, 22.06.2019 20:00

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

You know the right answer?

Helix Company has been approached by a new customer to provide 2,000 units of its regular product at...

Questions

Mathematics, 13.01.2021 04:50

Mathematics, 13.01.2021 04:50

Mathematics, 13.01.2021 04:50

Mathematics, 13.01.2021 04:50

Mathematics, 13.01.2021 04:50

Physics, 13.01.2021 04:50

Mathematics, 13.01.2021 04:50

Social Studies, 13.01.2021 04:50

Social Studies, 13.01.2021 04:50

Health, 13.01.2021 04:50

Mathematics, 13.01.2021 04:50

Computers and Technology, 13.01.2021 04:50

Business, 13.01.2021 04:50

Physics, 13.01.2021 04:50