Business, 05.05.2020 17:15 isaacbryan2416

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee.

Gross Pay through August Gross Pay for September

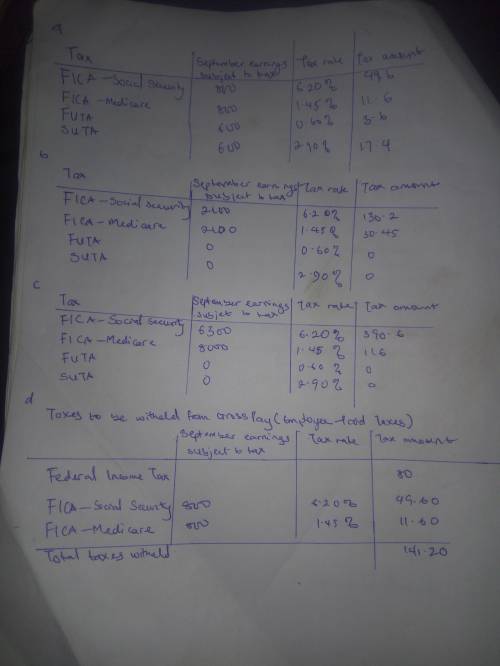

a. $ 6,400 $ 800

b. $ 18,200 $ 2,100

c. $ 112,200 $ 8,000

Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). (Round your answers to 2 decimal places.)

a.)

Tax September Earnings Subject to Tax Tax Rate Tax Amount

FICA-Social Security

FICA-Medicare

FUTA

SUTA

b.)

Tax September Earnings Subject to Tax Tax Rate Tax Amount

FICA-Social Security

FICA-Medicare

FUTA

SUTA

c.)

Tax September Earnings Subject to Tax Tax Rate Tax Amount

FICA-Social Security

FICA-Medicare

FUTA

SUTA

d.) Assuming situation a, prepare the employer’s September 30 journal entries to record salary expense and its related payroll liabilities for this employee. The employee’s federal income taxes withheld by the employer are $80 for this pay period. (Round your answers to 2 decimal places.)

Taxes to be Withheld From Gross Pay (Employee-Paid Taxes)

September Earnings Subject to Tax Tax Rate Tax Amount

Federal income tax

Total:

e. Prepare the employer's September 30 journal entry to record accrued salary expense and its related payroll liabilities for this employee.

DATE GENERAL JOURNAL DEBIT CREDIT

Sep 30

f.) Assuming situation a, prepare the employer’s September 30 journal entries to record the employer’s payroll taxes expense and its related liabilities. (Round your answers to 2 decimal places.)

Employer Payroll Taxes September earnings subject to tax Tax Rate Tax Amount

Total:

g.)

DATE GENERAL JOURNAL DEBIT CREDIT

Sep 30

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

He set of companies a product goes through on the way to the consumer is called the a. economic utility b. cottage industry c. market saturation d. distribution chain

Answers: 3

Business, 23.06.2019 01:00

Gideon company uses the allowance method of accounting for uncollectible accounts. on may 3, the gideon company wrote off the $2,000 uncollectible account of its customer, a. hopkins. on july 10, gideon received a check for the full amount of $2,000 from hopkins. on july 10, the entry or entries gideon makes to record the recovery of the bad debt is

Answers: 1

Business, 23.06.2019 02:40

Peter, the marketing manager of a company that manufactures church furniture, has been given the job of increasing corporate profits by five percent during the upcoming year. peter decided to give his assistant the full responsibility and authority for developing a mailing campaign to target churches in an entire state. in other words, peter has

Answers: 1

You know the right answer?

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its...

Questions

English, 01.12.2021 17:30

Mathematics, 01.12.2021 17:30

English, 01.12.2021 17:30

Mathematics, 01.12.2021 17:30

Computers and Technology, 01.12.2021 17:30

Mathematics, 01.12.2021 17:30

Health, 01.12.2021 17:30

Social Studies, 01.12.2021 17:30

Mathematics, 01.12.2021 17:30

Computers and Technology, 01.12.2021 17:30

Mathematics, 01.12.2021 17:30