Paul is going to buy a collectible vintage painting from a local art gallery. the painting is priced at $600 in the gallery. the gallery owner does accept credit cards but prefers cash. in fact, he offers to give paul a 5% discount if he can pay in cash. paul doesn't have any cash but can get a cash advance on his credit card. his credit card has an apr of 16% on credit purchases and a 32% apr on cash advances. assuming paul wants to pay the painting off over 12 months, which of the following is true?

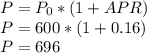

a. paul will pay a total of $696, over 12 months, if he purchases the painting with his credit card.

b. paul will pay a total of $653.28, over 12 months, if he purchases the painting with his credit card.

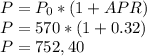

c. paul will pay a total of $782.40, over 12 months, if he purchases the painting with a cash advance for discounted purchase price.

d. paul will pay a total of $708.96, over 12 months, if he purchases the painting with a cash advance for discounted purchase price.

Answers: 1

Another question on Business

Business, 22.06.2019 02:30

Luc do purchased stocks for $6,000. he paid $4,000 in cash and borrowed $2,000 from the brokerage firm. he bought 100 shares at $60.00 per share ($6,000 total). the loan has an annual interest rate of 8 percent. six months later, luc do sold the stock for $65 per share. he paid a commission of $120 and repaid the loan. his net profit was how much? pls

Answers: 3

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Business, 22.06.2019 16:50

The cost of labor is significantly lower in many countries than in the united states. if you move manufacturing to a facility to a country labeled as part of the axis of evil and a threat to world peace you will increase the net income of your client by $10 million per the facility is located in a country which limits personal freedom and engages in state sponsored terrorism. imagine you are a marketing consultant. (a) what would you tell the executives to do? (b) what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 1

Business, 22.06.2019 17:50

Variable rate cd’s = $90 treasury bills = $150 discount loans = $20 treasury notes = $100 fixed rate cds = $160 money market deposit accts. = $140 savings deposits = $90 fed funds borrowing = $40 variable rate mortgage loans $140 demand deposits = $40 primary reserves = $50 fixed rate loans = $210 fed funds lending = $50 equity capital = $120 a. develop a balance sheet from the above data. be sure to divide your balance sheet into rate-sensitive assets and liabilities as we did in class and in the examples. b. perform a standard gap analysis and a duration analysis using the above data if you have a 1.15% decrease in interest rates and an average duration of assets of 5.4 years and an average duration of liabilities of 3.8 years. c. indicate if this bank will remain solvent after the valuation changes. if so, indicate the new level of equity capital after the valuation changes. if not, indicate the amount of the shortage in equity capital.

Answers: 3

You know the right answer?

Paul is going to buy a collectible vintage painting from a local art gallery. the painting is priced...

Questions

Mathematics, 10.05.2021 03:30

Mathematics, 10.05.2021 03:30

Mathematics, 10.05.2021 03:30

Mathematics, 10.05.2021 03:30

Social Studies, 10.05.2021 03:30

English, 10.05.2021 03:30

Mathematics, 10.05.2021 03:30

Mathematics, 10.05.2021 03:30

Chemistry, 10.05.2021 03:30

History, 10.05.2021 03:30

Social Studies, 10.05.2021 03:30

Mathematics, 10.05.2021 03:30

History, 10.05.2021 03:30