Business, 06.05.2020 01:58 mathsuxdix

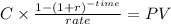

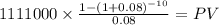

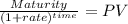

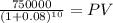

The resort project would require a $20,500,000 investment. At the end of ten years, some of the equipment would have a salvage value of $300,000. The project would require additional working capital $450,000 in the form of an increase in the minimum balance required by their bank and this working capital would be released at the end of the project. The project would provide estimated net income each year as follows:Sales $6,500,000

Less variable expenses 4,275,000

Contribution margin $2,225,000

Less fixed expenses:

Fixed expenses* $1,115,000

Net income $1,111,000

Answers: 1

Another question on Business

Business, 21.06.2019 14:00

Employees who are paid to complete a task, such as build a house, are paid on a(n) basis

Answers: 1

Business, 21.06.2019 17:20

Which of the following is a disadvantage of equity alliances when compared to non-equity alliances? 1. they are reflective of weaker ties between firms.2. they do not permit the exchange of explicit knowledge.3. they are more likely to bring about lack of trust and commitment.4. they require significantly higher levels of investment.

Answers: 2

Business, 22.06.2019 00:30

You wants to open a saving account.which account will grow his money the most

Answers: 1

Business, 22.06.2019 13:30

You operate a small advertising agency. you employ two secretaries, a graphic designer, three sales representatives, and an office coordinator. 1. what types of things would you consider when determining how to compensate each position? describe two (2) considerations. 2. what type of compensation plan would you use for each position?

Answers: 1

You know the right answer?

The resort project would require a $20,500,000 investment. At the end of ten years, some of the equi...

Questions

Mathematics, 03.07.2019 17:30

Mathematics, 03.07.2019 17:30

Mathematics, 03.07.2019 17:30

Mathematics, 03.07.2019 17:30

Mathematics, 03.07.2019 17:30

Mathematics, 03.07.2019 17:30

Mathematics, 03.07.2019 17:30

Mathematics, 03.07.2019 17:30