Common stock valuelong dashAll growth models Personal Finance Problem You are evaluating the potential purchase of a small business currently generating $42 comma 500 of after-tax cash flow (Upper D 0equals$42 comma 500). On the basis of a review of similar-risk investment opportunities, you must earn a rate of return of 18% on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using two possible assumptions about the growth rate of cash flows.

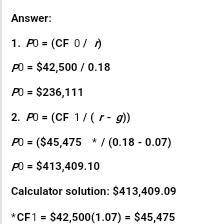

a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity?

b. What is the firm's value if cash flows are expected to grow at a constant rate of 7% from now to infinity?

c. What is the firm's value if cash flows are expected to grow at an annual rate of 12% for the first 2 years, followed by a constant annual rate of 7% from year 3 to infinity?

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Colah company purchased $1.8 million of jackson, inc. 8% bonds at par on july 1, 2018, with interest paid semi-annually. when the bonds were acquired colah decided to elect the fair value option for accounting for its investment. at december 31, 2018, the jackson bonds had a fair value of $2.08 million. colah sold the jackson bonds on july 1, 2019 for $1,620,000. the purchase of the jackson bonds on july 1. interest revenue for the last half of 2018. any year-end 2018 adjusting entries. interest revenue for the first half of 2019. any entry or entries necessary upon sale of the jackson bonds on july 1, 2019. required: 1. prepare colah's journal entries for above transaction.

Answers: 1

Business, 21.06.2019 22:40

In allentown, pennsylvania, in the summer of 2014, the average price of a gallon of gasoline was $3.68long dasha 22-cent increase from the year before. many consumers were upset by the increase. one was quoted in a local newspaper as saying, "it's crazy. the government should step in." source: sam kennedy, "valley feeling pain at the pump," (allentown, pa) morning call, june 21, 2014. suppose the government had stepped in and imposed a price ceiling equal to old price of $3.46 per gallon. a. using the line drawing tool, draw and label the price ceiling. carefully follow the instructions above, and only draw the required object.

Answers: 3

Business, 22.06.2019 05:10

Suppose that the free states of eldricia, a small nation, has consumption, investment, government purchases, imports, and exports as follows. consumption $140 investment $50 government purchases $45 imports $30 exports $15 calculate the free states of eldricia's gdp

Answers: 2

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

You know the right answer?

Common stock valuelong dashAll growth models Personal Finance Problem You are evaluating the potenti...

Questions

Chemistry, 16.12.2019 21:31

History, 16.12.2019 21:31

Mathematics, 16.12.2019 21:31

Business, 16.12.2019 21:31

History, 16.12.2019 21:31

Biology, 16.12.2019 21:31

Mathematics, 16.12.2019 21:31

Mathematics, 16.12.2019 21:31

History, 16.12.2019 21:31

Social Studies, 16.12.2019 21:31

Mathematics, 16.12.2019 21:31