Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash $ 132,000 $ 137,000 Accounts receivable 330,000 483,000 Inventory 573,000 476,000 Plant and equipment, net 845,000 824,000 Investment in Buisson, S. A. 397,000 431,000 Land (undeveloped) 248,000 251,000 Total assets $ 2,525,000 $ 2,602,000 Liabilities and Stockholders' Equity Accounts payable $ 385,000 $ 341,000 Long-term debt 1,014,000 1,014,000 Stockholders' equity 1,126,000 1,247,000 Total liabilities and stockholders' equity $ 2,525,000 $ 2,602,000 Joel de Paris, Inc. Income Statement Sales $ 4,180,000 Operating expenses 3,553,000 Net operating income 627,000 Interest and taxes: Interest expense $ 116,000 Tax expense 201,000 317,000 Net income $ 310,000 The company paid dividends of $189,000 last year. The "Investment in Buisson, S. A.," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%.

Required:

1. Compute the company's average operating assets for last year.

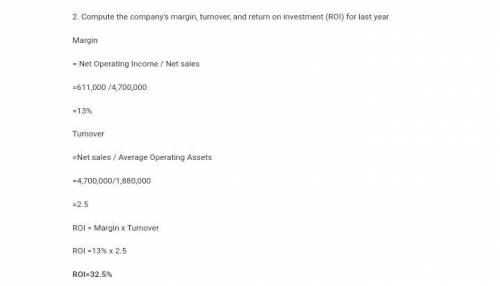

2. Compute the company’s margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.)

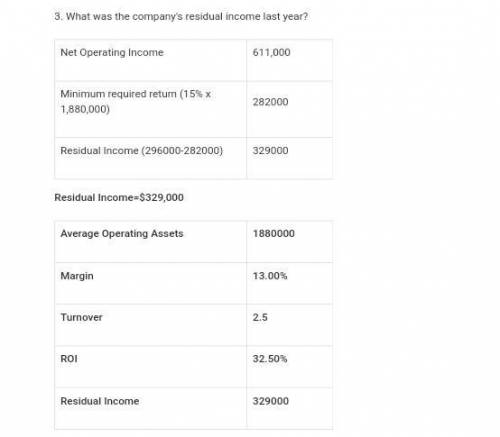

3. What was the company’s residual income last year?

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Identify the accounting assumption or principle that is described below. (a) select the accounting assumption or principle is the rationale for why plant assets are not reported at liquidation value. (note: do not use the historical cost principle.) (b) select the accounting assumption or principle indicates that personal and business record-keeping should be separately maintained. (c) select the accounting assumption or principle assumes that the dollar is the "measuring stick" used to report on financial performance. (d) select the accounting assumption or principle separates financial information into time periods for reporting purposes. (e) select the accounting assumption or principle measurement basis used when a reliable estimate of fair value is not available. (f) select the accounting assumption or principle dictates that companies should disclose all circumstances and events that make a difference to financial statement users.

Answers: 3

Business, 21.06.2019 21:30

In a macroeconomic context, what are implicit liabilities? money owed to people possessing government issued bonds. the amount of money that firms collectively owe to shareholders. money that the government has promised to pay in the future. payments that the federal government undertakes only during periods of recession. which of the choices is a significant implicit liability in the united states? military spending education spending national science foundation spending social security

Answers: 2

Business, 22.06.2019 00:20

Overspeculation and a decrease in consumer confidence are both leading factors of: ?

Answers: 1

Business, 22.06.2019 03:30

Instructions: use the following information to construct the 2000 balance sheet and income statement for carolina business machines. round all numbers to the nearest whole dollar. all numbers are in thousands of dollars. be sure to read the whole problem before you jump in and get started. at the end of 1999 the firm had $43,000 in gross fixed assets. in 2000 they purchased an additional $14,000 of fixed asset equipment. accumulated depreciation at the end of 1999 was $21,000. the depreciation expense in 2000 is $4,620. at the end of 2000 the firm had $3,000 in cash and $3,000 in accounts payable. in 2000 the firm extended a total of $9,000 in credit to a number of their customers in the form of accounts receivable. the firm generated $60,000 in sales revenue in 2000. their cost of goods sold was 60 percent of sales. they also incurred salaries and wages expense of $10,000. to date the firm has $1,000 in accrued salaries and wages. they borrowed $10,000 from their local bank to finance the $15,000 in inventory they now have on hand. the firm also has $7,120 invested in marketable securities. the firm currently has $20,000 in long-term debt outstanding and paid $2,000 in interest on their outstanding debt. over the firm's life, shareholders have put up $30,000. eighty percent of the shareholder's funds are in the form of retained earnings. the par value per share of carolina business machines stock is

Answers: 3

You know the right answer?

Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Begi...

Questions

History, 15.04.2021 17:00

History, 15.04.2021 17:00

Mathematics, 15.04.2021 17:00

Chemistry, 15.04.2021 17:00

Physics, 15.04.2021 17:00

Mathematics, 15.04.2021 17:00

Mathematics, 15.04.2021 17:00

Mathematics, 15.04.2021 17:00