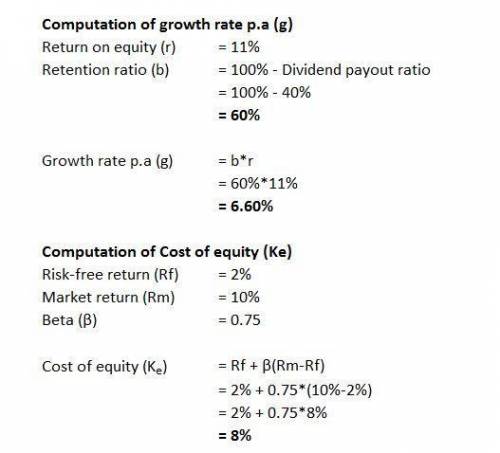

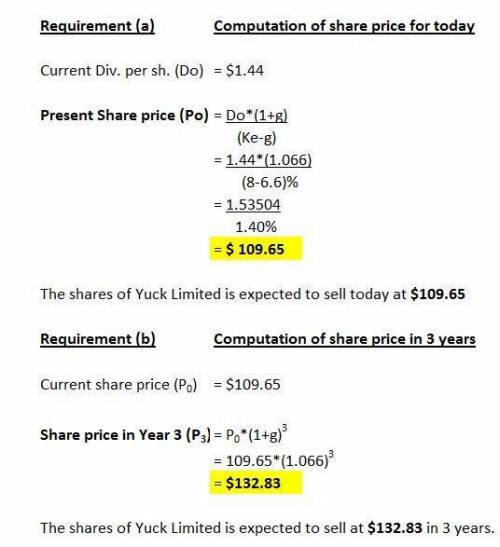

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, currently has a dividend payout ratio of 40%. Its beta is 0.75 and its current dividend per share is $1.44 per year. Suppose YUCK has a return on equity of 11% and the risk-free rate is 2% while the expected annual return on the S&P 500 is 10%.

(a) At what price do you expect a share of YUCK to sell for today?

(b) At what price do you expect YUCK to sell in three years?

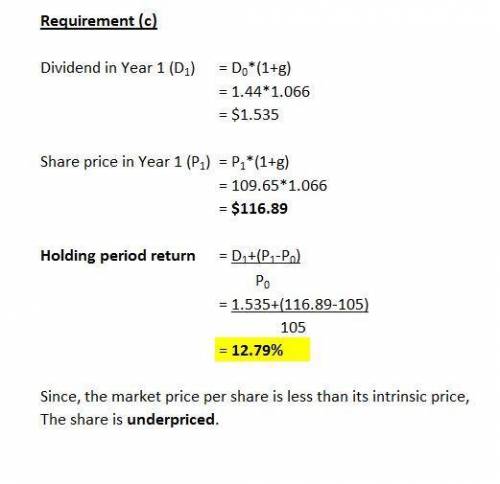

(c) It turns out that YUCK currently sells for $105. If you expect that YUCK’s market price will equal its intrinsic value 1 year from now, what is your expected 1 year holding period return on YUCK stock? What does this imply about under/overpricing and alphas?

Answers: 2

Another question on Business

Business, 22.06.2019 07:40

Alicia has a collision deductible of $500 and a bodily injury liability coverage limit of $50,000. she hits another driver and injures them severely. the case goes to trial and there is a verdict to compensate the injured person for $40,000 how much does she pay?

Answers: 1

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 20:10

Your sister is thinking about starting a new business. the company would require $375,000 of assets, and it would be financed entirely with common stock. she will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an roe of 13.5%. how much net income must be expected to warrant starting the business? a. $41,234b. $43,405c. $45,689d. $48,094e. $50,625

Answers: 3

Business, 22.06.2019 20:20

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

You know the right answer?

Suppose YUCK! (YUCK), the parent company of many fast food chains that compete with McDonalds, curre...

Questions

English, 06.10.2019 21:30

Mathematics, 06.10.2019 21:30

Business, 06.10.2019 21:30

Mathematics, 06.10.2019 21:30

Mathematics, 06.10.2019 21:30

Mathematics, 06.10.2019 21:30

History, 06.10.2019 21:30

English, 06.10.2019 21:30

Mathematics, 06.10.2019 21:30