Business, 06.05.2020 07:09 jamessmith86

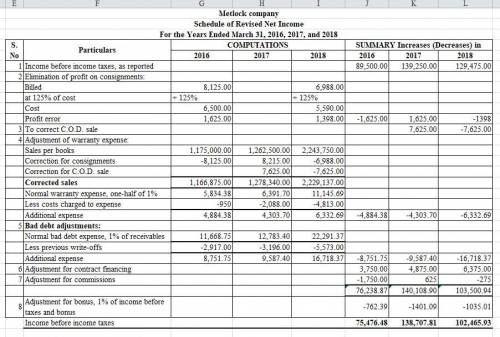

You have been asked by a client to review the records of Metlock Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have been made for you to review the accounting records. Your examination reveals the following information.

1. Metlock Company commenced business on April 1, 2015, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes.

Year Ended March 31 Income Before Taxes

2016 $89,500

2017 139,250

2018 129,475

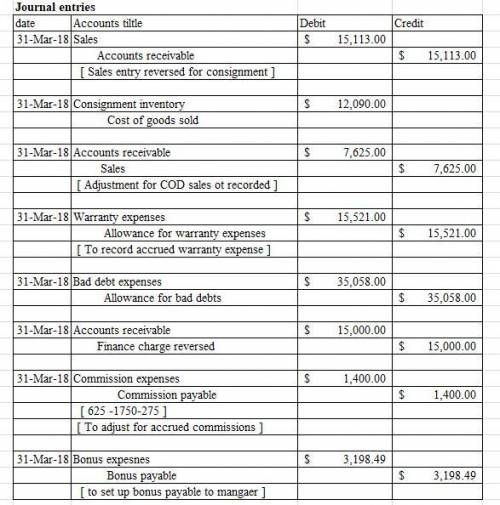

2. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each year, machines billed and in the hands of consignees amounted to:

2016 $8,125

2017 none

2018 6,988

Sales price was determined by adding 25% to cost. Assume that the consigned machines are sold the following year.

3. On March 30, 2017, two machines were shipped to a customer on a C. O.D. basis. The sale was not entered until April 5, 2017, when cash was received for $7,625. The machines were not included in the inventory at March 31, 2017. (Title passed on March 30, 2017.)

4. All machines are sold subject to a 5-year warranty. It is estimated that the expense ultimately to be incurred in connection with the warranty will amount to 1/2 of 1% of sales. The company has charged an expense account for warranty costs incurred.

Sales per books and warranty costs were as follows.

Warranty Expense for Sales Made in

Year Ended March 31 Sales 2016 2017 2018 Total

2016 $1,175,000 $950 $950

2017 1,262,500 450 $1,638 2,088

2018 2,243,750 400 2,025 $2,388 4,813

5. Bad debts have been recorded on a direct write-off basis. Experience of similar enterprises indicates that losses will approximate 1% of receivables. Bad debts written off were:

Bad Debts Incurred on Sales Made in

2016 2017 2018 Total Bad Debt Expense Based on 1% of Receivables

2016 $938 $938 $2,917

2017 1,000 $650 1,650 3,196

2018 438 2,250 $2,125 4,813 5,573

6. The bank deducts 6% on all contracts financed. Of this amount, 1/2% is placed in a reserve to the credit of Metlock Company that is refunded to Metlock as finance contracts are paid in full. (Thus, Metlock should have a receivable for these payments and should record revenue when the net balance is remitted each year.) The reserve established by the bank has not been reflected in the books of Metlock. The excess of credits over debits (net increase) to the reserve account with Metlock on the books of the bank for each fiscal year were as follows.

2016 $3,750

2017 4,875

2018 6,375

$15,000

7. Commissions on sales have been entered when paid. Commissions payable on March 31 of each year were as follows.

2016 $1,750

2017 1,125

2018 1,400

8. A review of the corporate minutes reveals the manager is entitled to a bonus of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid.

Required:

1. Present a schedule showing the revised income before income taxes for each of the years ended March 31, 2016, 2017, and 2018. (Enter negative amounts using either a negative sign preceding the number e. g. -15,000 or parentheses e. g. (15,000). Round answers to the nearest whole dollar, e. g. 5,275.)

Answers: 3

Another question on Business

Business, 22.06.2019 06:40

Self-interest achieve society’s economic goals because producers know which goods consumers want the most. as consumers and producers exercise their freedom to act in their own self-interest, markets will produce the desired goods at the lowest possible cost. consumers and producers both operate based on society’s economic goals. consumers know which goods can be produced at the lowest cost. there is a wide variety of desired goods and services in a market system because producers determine what to produce. consumers change their minds frequently. there is always a need to produce something new and improved. individual wants are diverse. what is produced is ultimately determined by consumers, because if the goods offered are not what consumers want, consumers will not buy them. producers, because they are driven by profits. producers, because they determine what to produce. consumers, because they participate in marketing surveys.

Answers: 2

Business, 22.06.2019 11:00

Companies hd and ld are both profitable, and they have the same total assets (ta), total invested capital, sales (s), return on assets (roa), and profit margin (pm). both firms finance using only debt and common equity. however, company hd has the higher total debt to total capital ratio. which of the following statements is correct? a) company hd has a higher assets turnover than company ld. b) company hd has a higher return on equity than company ld. c) none of the other statements are correct because the information provided on the question is not enough. d) company hd has lower total assets turnover than company ld. e) company hd has a lower operating income (ebit) than company ld

Answers: 2

Business, 22.06.2019 11:00

If the guide wprds on the page are "crochet " and "crossbones", which words would not be on the page. criticize, crocodile,croquet,crouch,crocus.

Answers: 1

Business, 22.06.2019 19:20

Sanibel autos inc. merged with its competitor vroom autos inc. this allowed sanibel autos to use its technological competencies along with vroom autos' marketing capabilities to capture a larger market share than what the two entities individually held. what type of integration does this scenario best illustrate? a. vertical b. technological c. horizontal d. perfect

Answers: 2

You know the right answer?

You have been asked by a client to review the records of Metlock Company, a small manufacturer of pr...

Questions

History, 07.11.2019 20:31

English, 07.11.2019 20:31

English, 07.11.2019 20:31

English, 07.11.2019 20:31

Mathematics, 07.11.2019 20:31

Mathematics, 07.11.2019 20:31