Business, 06.05.2020 07:01 latiamason16

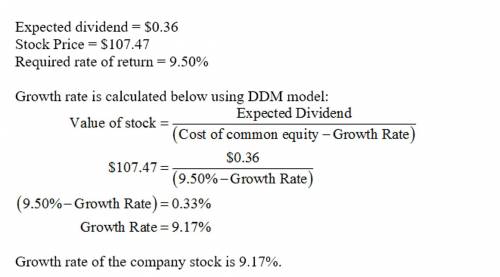

Estimating WACC and Expected Growth in Dividends ModelAssume FedEx Corporation (NYSE: FDX) was trading at $107.47 at May 31, 2011. Its dividend per share was $0.36, its market beta was estimated to be 0.7, its average borrowing rate is 9.5%, and its marginal tax rate is 36%. FedEx's market value of equity (market cap) is $32.95 billion and its total market value (enterprise value) is $34.31 billion. Assume a risk-free rate of 5.4% and a market risk premium of 5.8% to answer the following requirements.(a) Estimate FedEx's cost of debt capital, cost of equity capital, and weighted average cost of capital. (Round your answers to one decimal place.)Cost of debt capital = Answer%Cost of equity capital = Answer%Calculate the weighted average cost of capital. (Use rounded answers from above. Do not round until your final answer. Round to one decimal place.)Weighted average cost of capital = Answer%(b) Using the dividend discount model, and assuming a constant perpetuity for dividends, estimate FedEx's intrinsic value per share. (Use the rounded cost of equity capital calculated in (a). Round your answer to two decimal places.)$Answer(c) Using the Gordon growth DDM, and assuming next period's dividends equal $0.36 and grow at a constant rate for each period thereafter, infer the market's expected growth in dividends that are necessary for FedEx's intrinsic value from the model to equal $107.47 per common share. Assume that its cost of equity capital is 9.5%. (Do not round until your final answer. Round to one decimal place.)

Answers: 3

Another question on Business

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 16:40

Match the situations that will develop one's personality and those that won't peter is surrounded by friends who are always encouraging him jonathan always watches television when he wants to take a break from his books libby sets small targets for herself and strives to achieve them. the smiths indulge in an animated discussion on varied topics every evening after dinner. brook loves junk food and exercises once in a while. develops your personality develops doesn't develop your personality

Answers: 2

Business, 22.06.2019 19:20

Bcorporation, a merchandising company, reported the following results for october: sales $ 490,000 cost of goods sold (all variable) $ 169,700 total variable selling expense $ 24,200 total fixed selling expense $ 21,700 total variable administrative expense $ 13,200 total fixed administrative expense $ 33,600 the contribution margin for october is:

Answers: 1

Business, 23.06.2019 11:40

There's a cartoon that has become a social media meme. two pigs are chatting. the first pig says, "isn't it great? we have to pay nothing for the barn." the second pig replies. "yeah! and even the food is free." this cartoon is frequently linked to a quote that goes something like this: "if you're not paying for it, you're not the customer; you're the product being sold." what do these statements imply about social media? what are the specific ways that social media users become a product that is being sold?

Answers: 3

You know the right answer?

Estimating WACC and Expected Growth in Dividends ModelAssume FedEx Corporation (NYSE: FDX) was tradi...

Questions

Computers and Technology, 28.07.2019 06:30

Computers and Technology, 28.07.2019 06:30

Social Studies, 28.07.2019 06:30

Business, 28.07.2019 06:40

Biology, 28.07.2019 06:40

Biology, 28.07.2019 06:40

Health, 28.07.2019 06:40