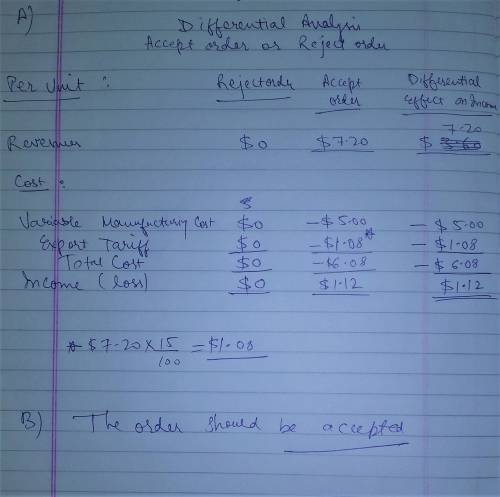

Product A is normally sold for $9.60 per unit. A special price of $7.20 is offered for the export market. The variable production cost is $5.00 per unit. An additional export tariff of 15% of revenue must be paid for all export products. Assume that there is sufficient capacity for the special order. Prepare a differential analysis dated March 16 on whether to reject (Alternative 1) or accept (Alternative 2) the special order. Round your answers to two decimal places. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) March 16 Reject Order (Alternative 1) Accept Order (Alternative 2) Differential Effect on Income (Alternative 2) Revenues, per unit $ $ $ Costs: Variable manufacturing costs, per unit Export tariff, per unit Income (Loss), per unit $ $ $ Should the special order be rejected (Alternative 1) or accepted (Alternative 2)?

Answers: 2

Another question on Business

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 06:00

Select the correct answer a research organization conducts certain chemical tests on samples. they have data available on the standard results. some of the samples give results outside the boundary of the standard results. which data mining method follows a similar approach? o a. data cleansing ob. network intrusion o c. fraud detection od. customer classification o e. deviation detection

Answers: 1

Business, 22.06.2019 06:30

If a seller prepaid the taxes of $4,400 and the closing is set for may 19, using the 12 month/30 day method what will the buyer owe the seller as prorated taxes?

Answers: 1

Business, 22.06.2019 17:40

Turrubiates corporation makes a product that uses a material with the following standards standard quantity 8.0 liters per unit standard price $2.50 per liter standard cost $20.00 per unit the company budgeted for production of 3,800 units in april, but actual production was 3,900 units. the company used 32,000 liters of direct material to produce this output. the company purchased 20,100 liters of the direct material at $2.6 per liter. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for april is:

Answers: 1

You know the right answer?

Product A is normally sold for $9.60 per unit. A special price of $7.20 is offered for the export ma...

Questions

Physics, 27.08.2019 06:30

Mathematics, 27.08.2019 06:30

Mathematics, 27.08.2019 06:30

Biology, 27.08.2019 06:30

Mathematics, 27.08.2019 06:30

Mathematics, 27.08.2019 06:30

History, 27.08.2019 06:30

Mathematics, 27.08.2019 06:30

Mathematics, 27.08.2019 06:30

Social Studies, 27.08.2019 06:30

Business, 27.08.2019 06:30