Business, 23.04.2020 04:35 izzycheer7

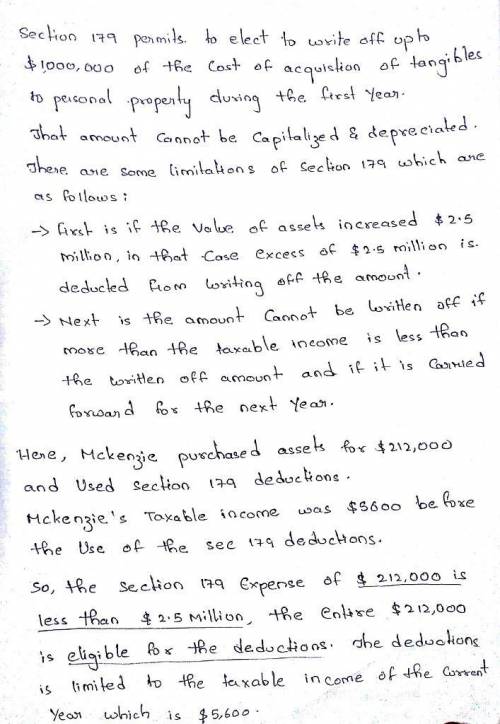

McKenzie purchased qualifying equipment for his business that cost $212,000 in 2018. The taxable income of the business for the year is $5,600 before consideration of any § 179 deduction. If an amount is zero, enter "0".

a. McKenzie's § 179 expense deduction is $ 5,600 for 2018. His § 179 carryover to 2019 is $ 206,400 .

b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment? Hint: See Concept Summary 8.5. McKenzie's § 179 expense deduction is ? for 2018. His § 179 carryover to 2019 is ?

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Chipotle mexican grill, the american mexican food chain restaurant, opened its first restaurant in the united states in 1993. in 2010, chipotle opened its first restaurant in the united kingdom in london on charing cross. by late may 2013, the company had 6 restaurants in london, but they have not been doing well even though the british have taken a liking to mexican food (boyle, 2013). why has this successful u.s. chain not seen the same success overseas? if you were chipotle's ceo, how would you fix this situation? what is an alternative means of venturing outside of its domestic markets that may allow for a competitive advantage? then, pick a company that has not yet expanded overseas, or if it has expanded, suggest a different strategy for entrance into an overseas market that you feel would be more strategic for the company. research its rivals in the global marketplace and market conditions in the overseas market you are targeting. justify your recommended entry strategy based on these industry and market conditions.

Answers: 1

Business, 21.06.2019 21:30

Daniel owns 100 shares of abc corporation's common stock. abc uses the fair value option, and recent declines in the firm's credit rating have caused the value of the firm's outstanding bonds payable to drop by 10%. daniel feels this is good news, but he wants to know what you think about the situation. which of the following represents your best response? a : "this situation may be positive for you in that the change in abc's credit standing indicates that the value of the firm's assets is likely increasing. however, the drop in bond value may negate any positive effects on your bottom line, because it means your claim on the firm's assets is simultaneously decreasing." b : "actually, this is bad news all around. the drop in the value of abc's bonds payable means shareholders' claims on the firm's assets have decreased. moreover, abc's declining credit rating means that the firm's assets are probably also dropping in value, thus magnifying your losses even more." c : "on the surface, this seems like good news because it means your claim on the firm's assets has increased. however, the drop in creditworthiness may also indicate that abc's assets are declining in value, thus offsetting any gains associated with the drop in bonds payable." d : "you're right! this is good news because it means that abc's debtholders have a decreased claim on the firm's assets. as a result, the firm's existing shareholders"like you"have seen their claim on the firm's assets increase."

Answers: 2

Business, 22.06.2019 09:00

According to this excerpt, a key part of our national security strategy is

Answers: 2

Business, 22.06.2019 10:50

Suppose that a firm is considering moving from a batch process to an assembly-line process to better meet evolving market needs. what concerns might the following functions have about this proposed process change: marketing, finance, human resources, accounting, and information systems?

Answers: 2

You know the right answer?

McKenzie purchased qualifying equipment for his business that cost $212,000 in 2018. The taxable inc...

Questions

Social Studies, 23.08.2019 01:00

Arts, 23.08.2019 01:00

Health, 23.08.2019 01:00

History, 23.08.2019 01:00

Physics, 23.08.2019 01:00

Arts, 23.08.2019 01:00

Social Studies, 23.08.2019 01:00

History, 23.08.2019 01:00

History, 23.08.2019 01:00

Mathematics, 23.08.2019 01:00

Social Studies, 23.08.2019 01:00

Social Studies, 23.08.2019 01:00

Mathematics, 23.08.2019 01:00