Business, 22.04.2020 04:09 SumayahAminaAnsari

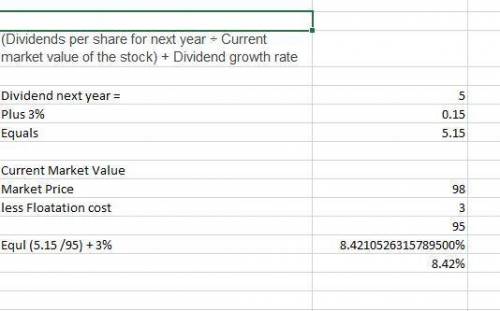

Firm X just paid $5/share dividend. We expect the dividend to grow annually at a constant rate 3%. The current stock price is $100. If firm X issues new equity, the new shares would sell at $98/share and the firm also needs to pay investment banks $3/share flotation cost. What is the cost of retained earnings? g

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Ok, so, theoretical question: if i bought the mona lisa legally, would anyone be able to stop me from eating it? why or why not?

Answers: 1

Business, 22.06.2019 09:40

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

Business, 22.06.2019 12:50

Salaries are $4,500 per week for five working days and are paid weekly at the end of the day fridays. the end of the month falls on a thursday. the accountant for dayton company made the appropriate accrual adjustment and posted it to the ledger. the balance of salaries payable, as shown on the adjusted trial balance, will be a (assume that there was no beginning balance in the salaries payable account.)

Answers: 1

Business, 22.06.2019 20:30

(30 total points) suppose a firm’s production function is given by q = l1/2*k1/2. the marginal product of labor and the marginal product of capital are given by: mpl = 1/ 2 1/ 2 2l k , and mpk = 1/ 2 1/ 2 2k l . a) (12 points) if the price of labor is w = 48, and the price of capital is r = 12, how much labor and capital should the firm hire in order to minimize the cost of production if the firm wants to produce output q = 18?

Answers: 1

You know the right answer?

Firm X just paid $5/share dividend. We expect the dividend to grow annually at a constant rate 3%. T...

Questions

English, 10.11.2020 02:30

Mathematics, 10.11.2020 02:30

Law, 10.11.2020 02:30

Mathematics, 10.11.2020 02:30

Mathematics, 10.11.2020 02:30

Biology, 10.11.2020 02:30

Mathematics, 10.11.2020 02:30

Social Studies, 10.11.2020 02:30

English, 10.11.2020 02:30

Mathematics, 10.11.2020 02:30

English, 10.11.2020 02:30

History, 10.11.2020 02:30

Mathematics, 10.11.2020 02:30

Mathematics, 10.11.2020 02:30

Spanish, 10.11.2020 02:30