Business, 22.04.2020 02:31 queenkimm26

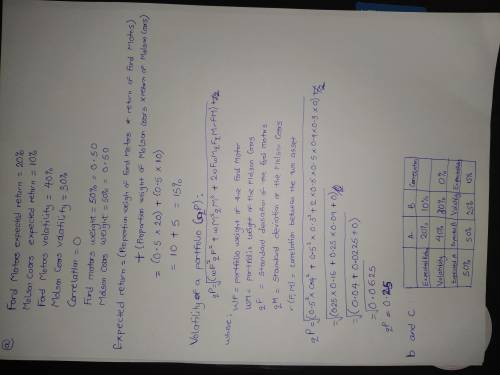

Suppose Ford Motor stock has an expected return of 20 % and a volatility of 40 %, and Molson Coors Brewing has an expected return of 10 % and a volatility of 30 %. If the two stocks are uncorrelated, a. What is the expected return and volatility of a portfolio consisting of 50 % Ford Motor stock and 50 % of Molson Coors Brewing stock? b. Given your answer to (a), is investing all of your money in Molson Coors stock an efficient portfolio of these two stocks? c. Is investing all of your money in Ford Motor an efficient portfolio of these two stocks? a. What is the expected return and volatility of a portfolio of 50 % Ford Motor stock and 50 % of Molson Coors Brewing stock? The expected return of the portfolio is

Answers: 2

Another question on Business

Business, 21.06.2019 19:30

Which of the following is an example of the use of fiscal policy by the u.s. government? a. congress makes it illegal for the police union to go on strike. b. the federal reserve bank lowers the interest rate on loans to corporations. c. the department of transportation increases spending on highway repairs. d. the supreme court rules that unions have the right to collective bargaining. 2b2t

Answers: 1

Business, 22.06.2019 02:30

Sweeten company had no jobs in progress at the beginning of march and no beginning inventories. the company has two manufacturing departments--molding and fabrication. it started, completed, and sold only two jobs during march—job p and job q. the following additional information is available for the company as a whole and for jobs p and q (all data and questions relate to the month of march): molding fabrication total estimated total machine-hours used 2,500 1,500 4,000 estimated total fixed manufacturing overhead $ 10,000 $ 15,000 $ 25,000 estimated variable manufacturing overhead per machine-hour $ 1.40 $ 2.20 job p job q direct materials $ 13,000 $ 8,000 direct labor cost $ 21,000 $ 7,500 actual machine-hours used: molding 1,700 800 fabrication 600 900 total 2,300 1,700 sweeten company had no underapplied or overapplied manufacturing overhead costs during the month. required: for questions 1-8, assume that sweeten company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. for questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 1. what was the company’s plantwide predetermined overhead rate? (round your answer to 2 decimal places.) next

Answers: 2

Business, 22.06.2019 12:30

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

You know the right answer?

Suppose Ford Motor stock has an expected return of 20 % and a volatility of 40 %, and Molson Coors B...

Questions

Advanced Placement (AP), 13.09.2021 22:00

Mathematics, 13.09.2021 22:00

Geography, 13.09.2021 22:00

English, 13.09.2021 22:00

Mathematics, 13.09.2021 22:00

Health, 13.09.2021 22:00

History, 13.09.2021 22:00

Mathematics, 13.09.2021 22:00

Mathematics, 13.09.2021 22:00

Health, 13.09.2021 22:00

English, 13.09.2021 22:00

Mathematics, 13.09.2021 22:00

World Languages, 13.09.2021 22:00