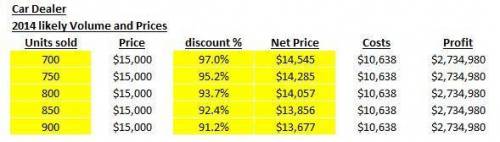

In November 2013, a car dealer is trying to determine how many cars to order from the manufacturer for 2014. A car ordered in 2013 cost $10000. The dealer expects that each car ordered from the manufacturer will cost 4% to 8% more in 2014. The selling price for each car in 2013 was $15000 but the dealer expects he will have to give a discount because of heavy competition, and that the selling price in 2014 will be between 93% and 98% of the 2013 price. The dealer expects to sell between 700 and 900 cars. Refer to the Car Dealership Problem and start with the original values. The cost increase is 6.38%. If the dealer's profits are $2,734,980, what was the discount and how many cars did the dealer sell?

Answers: 3

Another question on Business

Business, 22.06.2019 10:40

What would happen to the equilibrium price and quantity of lattés if the cost to produce steamed milk

Answers: 1

Business, 22.06.2019 12:00

Suppose there are three types of consumers who attend concerts at your university’s performing arts center: students, staff, and faculty. each of these groups has a different willingness to pay for tickets; within each group, willingness to pay is identical. there is a fixed cost of $1,000 to put on a concert, but there are essentially no variable costs. for each concert: i. there are 140 students willing to pay $20. (ii) there are 200 staff members willing to pay $35. (iii) there are 100 faculty members willing to pay $50. a) if the performing arts center can charge only one price, what price should it charge? what are profits at this price? b) if the performing arts center can price discriminate and charge two prices, one for students and another for faculty/staff, what are its profits? c) if the performing arts center can perfectly price discriminate and charge students, staff, and faculty three separate prices, what are its profits?

Answers: 1

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

Business, 22.06.2019 15:30

For a firm that uses the weighted average method of process costing, which of the following must be true? (a) physical units can be greater than or less than equivalent units. (b) physical units must be equal to equivalent units. (c) equivalent units must be greater than or equal to physical units. (d) physical units must be greater than or equal to equivalent units.

Answers: 1

You know the right answer?

In November 2013, a car dealer is trying to determine how many cars to order from the manufacturer f...

Questions

Mathematics, 10.12.2020 01:00

Mathematics, 10.12.2020 01:00

History, 10.12.2020 01:00

Advanced Placement (AP), 10.12.2020 01:00

Biology, 10.12.2020 01:00

Health, 10.12.2020 01:00

Mathematics, 10.12.2020 01:00

Mathematics, 10.12.2020 01:00

Biology, 10.12.2020 01:00