Money, Inc., has no debt outstanding and a total market value of $240,000. Earnings before interest and taxes, EBIT, are projected to be $26,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 20 percent lower. Money is considering a $150,000 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 15,000 shares outstanding. Ignore taxes for this problem.

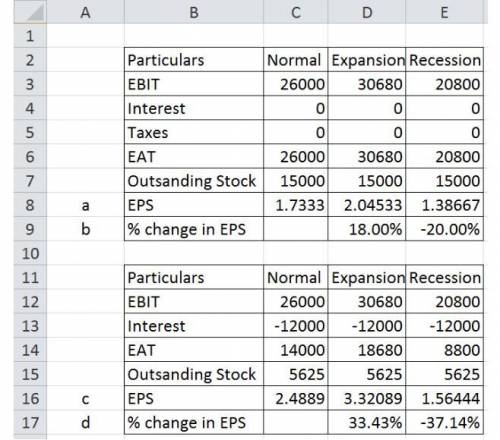

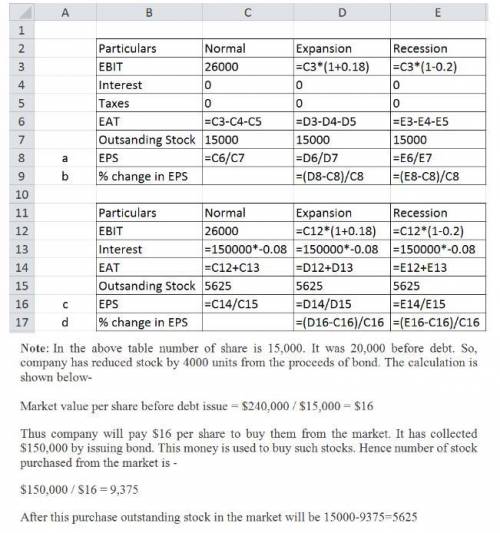

a. Calculate earnings per share, EPS, under each of the three economic scenarios (recession, normal, expansion) before any debt is issued.

b. Calculate the percentage changes in EPS when the economy expands or enters a recession.

c. Calculate earnings per share (EPS) under each of the three economic scenarios assuming the company goes through with recapitalization.

d. Given the recapitalization, calculate the percentage changes in EPS when the economy expands or enters a recession.

Answers: 1

Another question on Business

Business, 22.06.2019 08:10

The sec has historically raised questions regarding the independence of firms that derive a significant portion of their total revenues from one audit client or group of clients because the sec staff believes this situation causes cpa firms to

Answers: 3

Business, 22.06.2019 11:00

The role of the credit department includes: a. evaluating customers' credit applications to determine whether they meet the company's approval standards. b. approving all credit applications in order to avoid losing sales. c. collecting cash from customers. d. following unwritten approval standards for processing customers' credit applications.

Answers: 2

Business, 22.06.2019 19:20

After jeff bezos read about how the internet was growing by 2,000 percent a month, he set out to use the internet as a new distribution channel and founded amazon, which is now the world's largest online retailer. this is clearly an example of a(n)a. firm that uses closed innovation. b. entrepreneur who commercialized invention into an innovation. c. business that entered the industry during its maturity stage. d. exception to the long tail business model

Answers: 1

Business, 23.06.2019 00:30

It's possible for a debt card transaction to bounce true or false

Answers: 1

You know the right answer?

Money, Inc., has no debt outstanding and a total market value of $240,000. Earnings before interest...

Questions

Chemistry, 19.12.2019 06:31

History, 19.12.2019 06:31

Biology, 19.12.2019 06:31

History, 19.12.2019 06:31

Computers and Technology, 19.12.2019 06:31

History, 19.12.2019 06:31

Advanced Placement (AP), 19.12.2019 06:31

Mathematics, 19.12.2019 06:31

Chemistry, 19.12.2019 06:31

Mathematics, 19.12.2019 06:31

Social Studies, 19.12.2019 06:31

Mathematics, 19.12.2019 06:31

Mathematics, 19.12.2019 06:31

Mathematics, 19.12.2019 06:31