Business, 22.04.2020 00:42 corbin3582

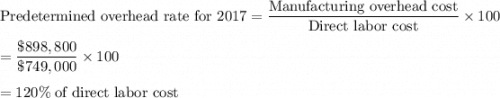

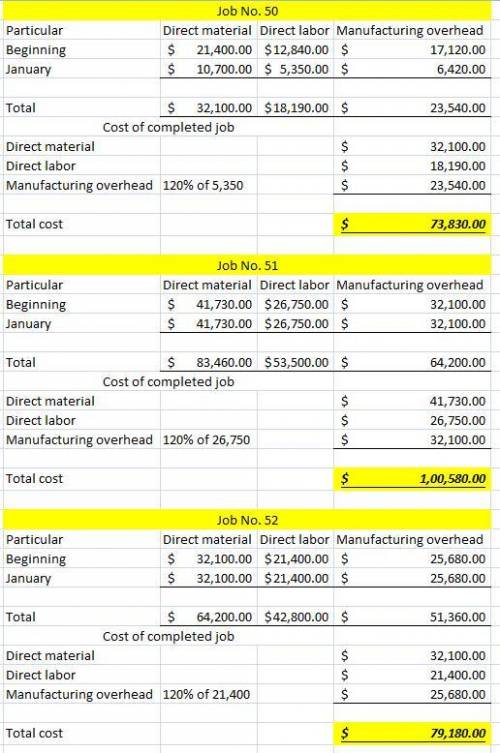

Problem 2-1A Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2017, Job No. 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $21,400, direct labor $12,840, and manufacturing overhead $17,120. As of January 1, Job No. 49 had been completed at a cost of $96,300 and was part of finished goods inventory. There was a $16,050 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $130,540 and $169,060, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $96,300 on account 2. Incurred factory labor costs of $74,900. Of this amount $17,120 related to employer payroll taxes. 3. Incurred manufacturing overhead costs as follows: indirect materials $18,190 indirect labor $21,400; depreciation expense on equipment $12,840 and various other manufacturing overhead costs on account $17,120 4. Assigned direct materials and direct labor to jobs as follows Job No Direct Materials Direct Labor $10,700 $5,350 50 51 41,730 26 750 52 32,100 21,400 Calculate the predetermined overhead rate for 2017, assuming Lott Company estimates total manufacturing overhead costs of $898,800, direct labor costs of $749,000, and direct labor hours of 21,400 for the year. (Round answer to the nearest whole percent, e. g. 25%.) Predetermined overhead rate Open job cost sheets for Jobs 50, 51, and 52. Enter the January 1 balances on the job cost sheet for Job No. 50 Job No. 50 Direct Materials Direct Labor Manufacturing Overhead Dat Beg Cost of completed job Direct materials Direct labor Manufacturing overhead Total cost

Answers: 2

Another question on Business

Business, 21.06.2019 20:00

Jorge is a manager at starbucks. his operational plan includes achieving annual sales of $4,000,000 for his store. with only one month left to end of the fiscal year, jorge realizes that he won't reach his annual sales goal. what are his options?

Answers: 2

Business, 22.06.2019 01:00

The penalties for a first-time dui charge include revocation of drivers license a. 180 days b. ben 180 des and one year c. bence 90 and 180 d. one year

Answers: 2

Business, 23.06.2019 01:30

Which of the following is considered part of a country’s infrastructure?

Answers: 1

Business, 23.06.2019 11:50

Andrew owns a store in polk county. his trade extends throughout river city, but not beyond the county limits. he sells his store to betty and, as part of the transaction, agrees not to engage in the same business anywhere in river city for a period of five years. a. the time restraint is likely reasonable. b. the geographic restraint is likely reasonable. c. the agreement likely violates antitrust laws and the provision is not enforceable. d. both (a) and (b).

Answers: 1

You know the right answer?

Problem 2-1A Lott Company uses a job order cost system and applies overhead to production on the bas...

Questions

Chemistry, 20.11.2020 23:10

Mathematics, 20.11.2020 23:10

History, 20.11.2020 23:10

English, 20.11.2020 23:10

Mathematics, 20.11.2020 23:10

Mathematics, 20.11.2020 23:10

Biology, 20.11.2020 23:10

Advanced Placement (AP), 20.11.2020 23:10

Mathematics, 20.11.2020 23:10

Computers and Technology, 20.11.2020 23:10

Mathematics, 20.11.2020 23:10

Mathematics, 20.11.2020 23:10