Alpha Electronics can purchase a needed service for $130 per unit. The same service can be provided by equipment that costs $100,000 and that will have a salvage value of 0 at the end of 10 years. Annual operating costs for the equipment will be $7,000 per year plus $25 per unit produced. MARR is 12%/year.

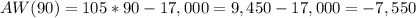

a) Whats the annual worth if the expected production is 90units/year? 510units/year?

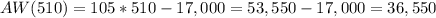

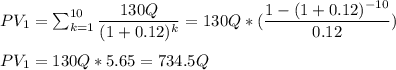

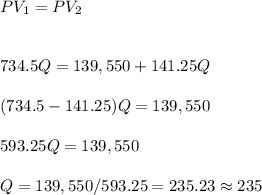

b)Determine the breakeven value for annual production that will return MARR on the investment in the new equipment.

Answers: 1

Another question on Business

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 22.06.2019 18:00

1. what is the amount of interest earned after two years on a $100 deposit paying 4 percent simple interest annually? $8.00 $4.08 $8.16 $4.00 2. what is the amount of compound interest earned after three years on a $100 deposit paying 8 percent interest annually? $24.00 $8.00 $16.64 $25.97 3. a business just took out a loan for $100,000 at 10% interest. if the business pays the loan off in three months, how much did the business pay in interest? $2,500.00 $10.00 $250.00 $10,000.00 4. what is the annual percentage yield (apy) for a deposit paying 5 percent interest with monthly compounding? 5.00% 5.12% 79.59% 0.42%

Answers: 1

Business, 22.06.2019 22:30

Ellen and george work for the same company. ellen, a gen xer, really appreciates the flextime opportunities, while george, a baby boomer, takes advantage of the free computer training offered at the company. these policies are examples of

Answers: 3

Business, 23.06.2019 02:30

Tara and her parents want to save at least $40,000 for college in 8 years. which statement describes the most effective savings plan for tara and her parents to meet their goal? tara and her parents should make deposits of $300 every month into a college savings account. tara and her parents should make deposits of $450 every month into a college savings account. tara and her parents should make deposits of $3,000 every year into a college savings account. tara and her parents should make deposits of $4,000 every year into a college savings account

Answers: 1

You know the right answer?

Alpha Electronics can purchase a needed service for $130 per unit. The same service can be provided...

Questions

Computers and Technology, 23.08.2019 04:10

Social Studies, 23.08.2019 04:20

Biology, 23.08.2019 04:20

Mathematics, 23.08.2019 04:20

Mathematics, 23.08.2019 04:20

Social Studies, 23.08.2019 04:20

Mathematics, 23.08.2019 04:20